Engineering, maintenance, and construction company Primoris Services Corp. (NASDAQ: PRIM) is riding a wave of stock market confidence that has generated strong gains. Is there still room for growth?

Engineering, maintenance, and construction company Primoris Services Corp. (NASDAQ: PRIM) is riding a wave of stock market confidence that has generated strong gains. Is there still room for growth?

Primoris had an impressive fourth quarter, reporting in February that it generated $897.3 million in revenue, $31.8 million in earnings, and a profit of $0.66 per share. This contributed to full-year results of $3.49 billion in revenue with a profit of $2.16 per share. This exceeded the Wall Street consensus and is helping to drive the stock forward. 2021 is expected to be another strong year for the company. Earnings are forecast to grow by at least 14% over the next year.

Because of the strong earnings and revenue, analysts are confident of an upside. The high-end target of $42.00 indicates a mild jump over today’s stock price. However, considering the momentum behind this pick, and the current confidence in the market related to the $1.9 trillion federal stimulus package, the estimates could be raised in the coming weeks.

The construction industry is expected to be strong in 2021, thanks to a recovery in consumer and infrastructure spending, and a stable home market. This is one of the best momentum stocks to consider as we move towards the second quarter.

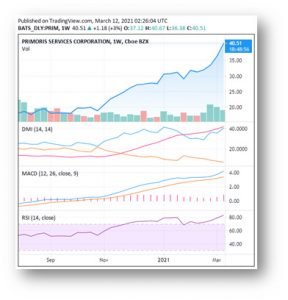

Key Data:

- 1 Year Price Growth: 37%

- YTD Price Growth: 72%

- 3 Month Price Growth: 59%

All information is based on current and historical market data, as well as publicly available financial data. As with any financial decision, your own research is important. Stock market outcomes can never be 100% accurately predicted. Familiarity with historical data, individual industries, and individual stocks is key to developing a robust portfolio. Note that stock prices can fluctuate rapidly during trading sessions.