The Dow Jones closed above 32,000 points for the first time on Wednesday, increasing 1.5% during the session. The stock market is showing signs of recovery from the recent pullback, and investors are looking for reliable picks. Dividend stocks are viable options while the Coronavirus still threatens the economy. Rent-A-Center Inc. (NYSE: RCII) is one of the best available.

The Dow Jones closed above 32,000 points for the first time on Wednesday, increasing 1.5% during the session. The stock market is showing signs of recovery from the recent pullback, and investors are looking for reliable picks. Dividend stocks are viable options while the Coronavirus still threatens the economy. Rent-A-Center Inc. (NYSE: RCII) is one of the best available.

This company specializes in furniture, appliance, computer, smartphone, and electronic rental-purchase agreements. It operates throughout the United States, Canada, and Puerto Rico. With many families facing financial challenges following the worst months of the pandemic, rent-to-own programs are in high demand. Rent-A-Center is historically a strong performer, and earnings growth is expected to continue with an increase of at least 18% over the next year.

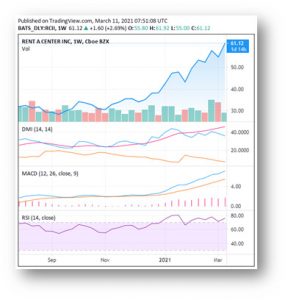

The stock has growth potential with an average target price of $67.71 and a high-end target price of $75.00. There’s also an income opportunity thanks to the 2.03% dividend yield on this stock today. Rent-A-Center is a unique consumer services stock to consider in March.

Key Data:

- 1 Year Price Growth: 03%

- YTD Price Growth: 62%

- 3 Month Price Growth: 13%

All information is based on current and historical market data, as well as publicly available financial data. As with any financial decision, your own research is important. Stock market outcomes can never be 100% accurately predicted. Familiarity with historical data, individual industries, and individual stocks is key to developing a robust portfolio. Note that stock prices can fluctuate rapidly during trading sessions.