MasterCraft Boat Holdings Inc. (NASDAQ: MCFT) is a designer, manufacturer, and retailer of stock and custom boats. It creates performance boats for recreational activities under the MasterCraft, Crest, and NauticStar brand segments.

MasterCraft Boat Holdings Inc. (NASDAQ: MCFT) is a designer, manufacturer, and retailer of stock and custom boats. It creates performance boats for recreational activities under the MasterCraft, Crest, and NauticStar brand segments.

Like many businesses, MasterCraft faced a challenging 2020, with a reduction in consumer spending. Earnings and revenue are expected to bounce back in 2021. Job numbers are increasing and so is consumer spending, which is good news for this boat manufacturer and others like it. MasterCraft leads the market in saltwater fishing boats, pontoon boats, and performance sports boats. In the most recent quarter, the company surprised analysts with earnings of $0.75 per share, beating the average consensus by 47%. Sales were up by 19% in the quarter.

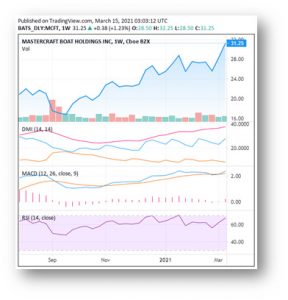

Over the next fiscal year, earnings are expected to increase by 46.84%. Earnings growth will help to support the company as it expands, and is likely to attract new investment, which would push the stock price upwards. Reasonably affordable and with a high-end target price of $40.00, this is one of the best growth stocks to consider in March.

Key Data:

- 1 Year Price Growth: 03%

- YTD Price Growth: 81%

- 3 Month Price Growth: 37%

All information is based on current and historical market data, as well as publicly available financial data. As with any financial decision, your own research is important. Stock market outcomes can never be 100% accurately predicted. Familiarity with historical data, individual industries, and individual stocks is key to developing a robust portfolio. Note that stock prices can fluctuate rapidly during trading sessions.