Since the mid-June market bottom, we’ve seen improvement in a large number of areas. Technology (XLK) has resumed its leadership role in a big way, as evidenced by the following relative breakout:

I believe this is just the beginning of the resumption of the secular bull market. If I’m correct, the XLK is likely to be your leading sector throughout the next advance. I’m concentrating heavily within this sector right now for trades.

Computer hardware ($DJUSCR), including Apple, Inc. (AAPL) have certainly aided the technology rebound. But we’re going to need most of the technology industry groups performing well to truly get everything back on track. One such industry, software ($DJUSSW), hasn’t exactly been a leader thus far:

First, trend lines are very subjective. If you connect intraday lows, you can see a slightly different version of a downtrend vs. if you connect closing lows. So when we see a channel breakout, I also like to see other positives, like recent absolute price highs being cleared, relative strength building, PPOs turning positive, bullish bounces off key moving averages like the 20-day EMA, etc. When I look at the DJUSSW, I definitely see improvement, but that bottom panel shows that software still isn’t favored within technology. What could change that?

Earnings.

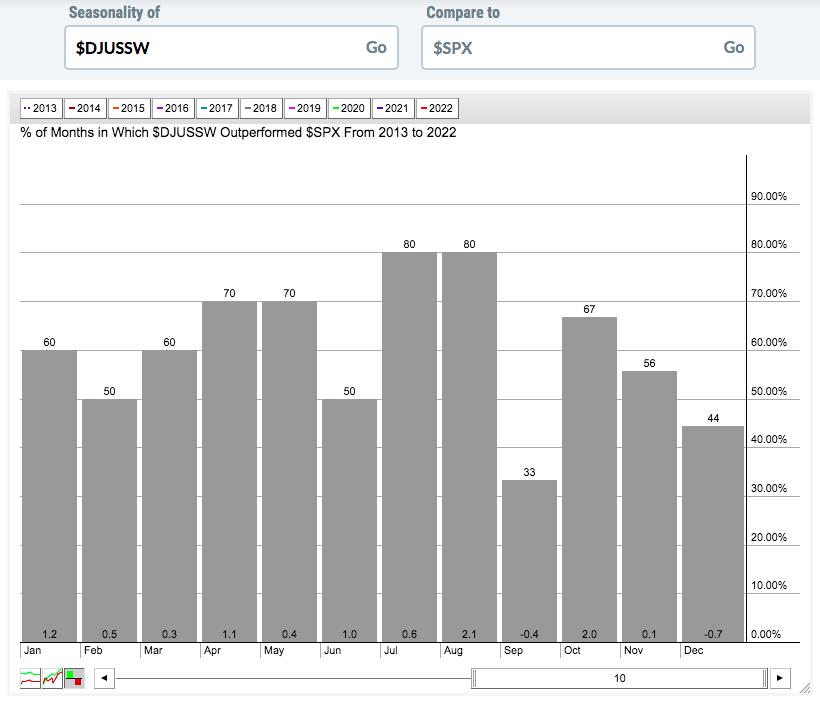

Before I get into the earnings, let me first highlight the relative seasonal strength vs. the benchmark S&P 500 that software has enjoyed over the past 10 years:

Software has outperformed the S&P 500 in 8 of the last 10 years during both July and August. In August, the average outperformance has been 2.1%, which is the highest of all 12 calendar months. So we know that August has been kind to this group.

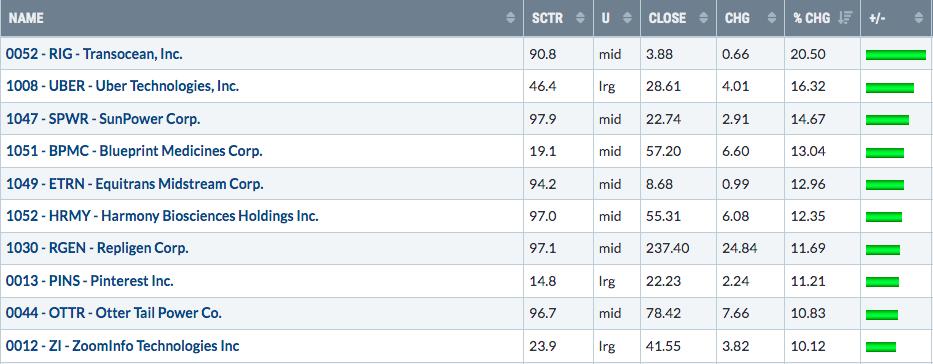

Now let’s turn our attention back to earnings. At EarningsBeats.com, we provide Upcoming Earnings ChartLists to all members of our community, including free EB Digest subscribers. For example, today’s ChartList provides our community with EVERY company with a market cap over $1 billion that reported earnings last night after the bell or this morning before the bell. So it summarizes all the changes in companies that just reported earnings. Want to know which companies are seeing the best reactions today after just reporting? Here’s today’s Top 10:

Want the Bottom 10?

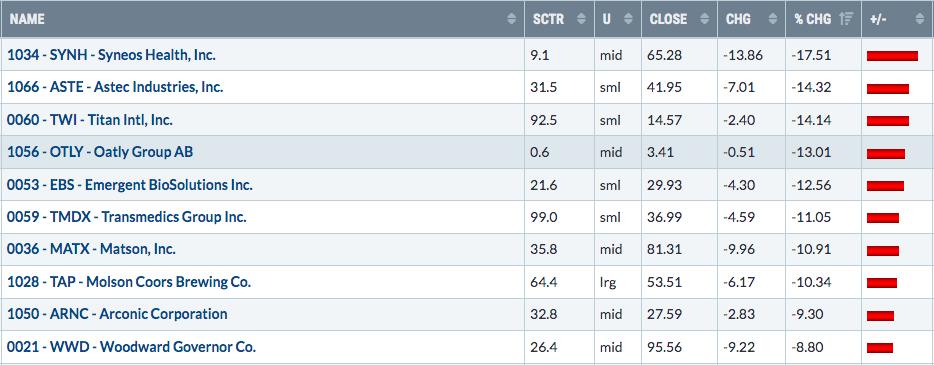

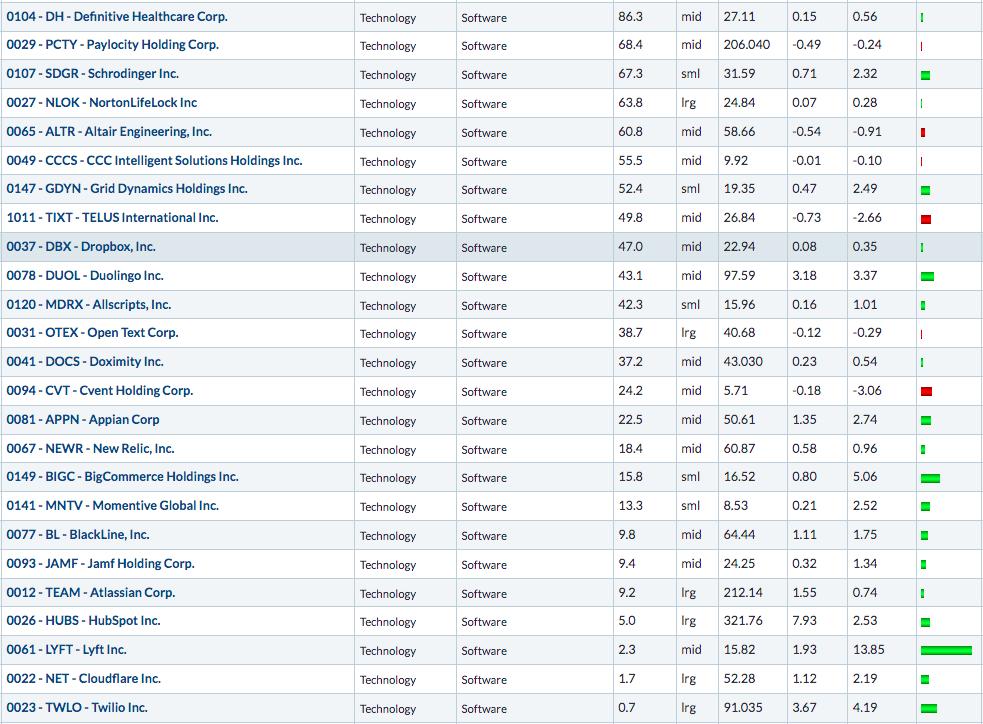

Now, would you like to see which software stocks reported and how they’re doing? Well, first you have to make sure the sector/industry appear in columns on your Summary table. Once I do that and sort it by industry, I can highlight how all the software companies are performing after reporting earnings:

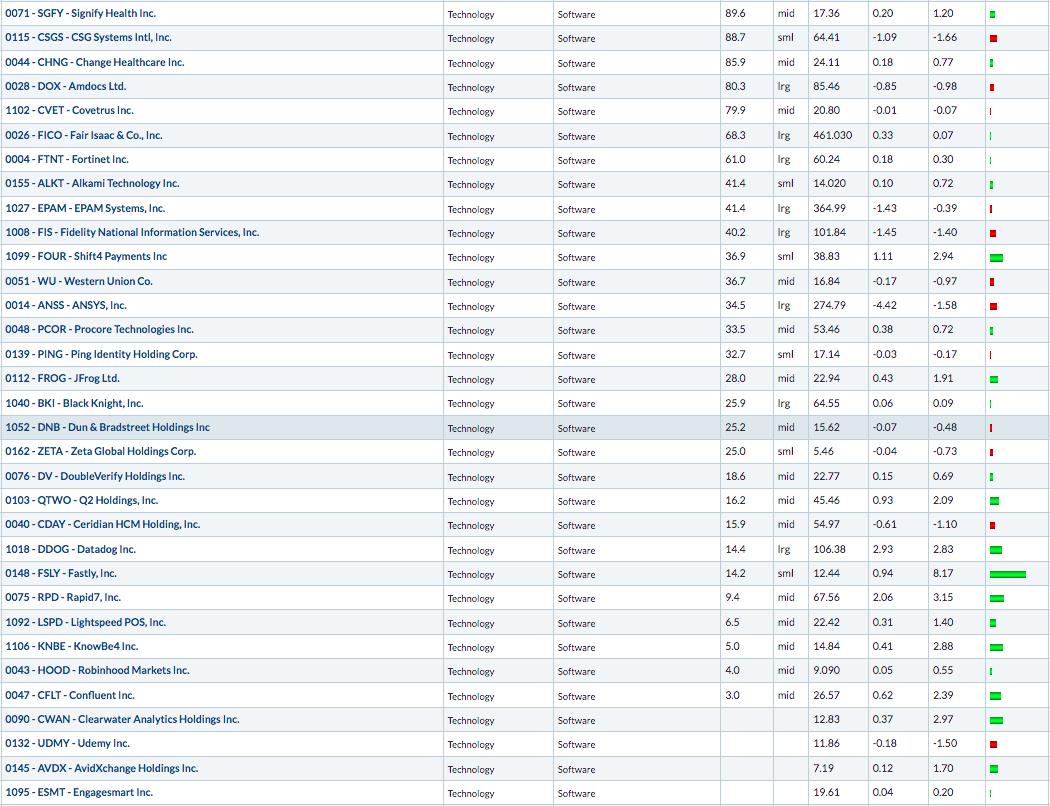

Now…..want to know which software stocks will be reporting later this week? Here they are – by day:

Reporting 8/2 AMC (after market close) or 8/3 BMO (before market open):

Reporting 8/3 AMC or 8/4 BMO:

Reporting 8/4 AMC or 8/5 BMO:

That’s a lot of software companies reporting earnings the next few days. They’re sorted in SCTR order, which is one way to look at relative strength. While I certainly wouldn’t use this in every instance, it’s quick gauge to help determine what we might expect with earnings. Higher SCTR scores indicate much better relative strength. Companies showing relative strength are much more likely to be favored by Wall Street and could lead to revenue and earnings beats (vs. consensus estimates).

Will these upcoming earnings reports provide the catalyst that software needs? We’re going to find out!

In my EB Digest article on Wednesday morning, I’ll be featuring one software company that I expect to absolutely blowout estimates. If you’d like to check this article out and download the Upcoming Earnings ChartLists into your own StockCharts.com account, simply CLICK HERE and provide me your name and email address. Our EB Digest is completely free with no credit card required. You may unsubscribe at any time.

Happy trading!

Tom