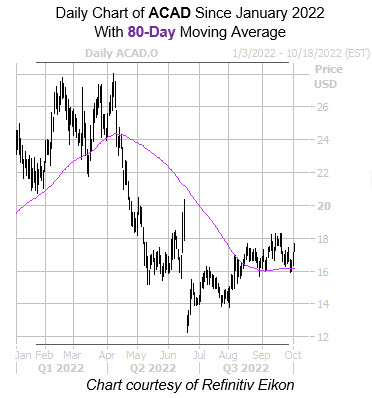

The security could overcome a technical level of resistance, too

This is because Acadia Pharmaceuticals stock just pulled back within one standard deviation of its 80-day moving average — a trendline with historically bullish implications. According to Schaeffer’s Senior Quantitative Analyst Rocky White’s last study, the security has seen four similar signals in the last three years, and was higher one month later 75% of the time, averaging an 9.1% gain. A move of similar magnitude would place ACAD above the $19 level for the first time since mid-June.

There’s still plenty of room for optimism among the brokerage bunch, which may push shares even higher. Of the 18 analysts in coverage, 11 call the security a tepid “hold” or worse. And while short sellers are hitting the exits, with short interest down 5.1% in the last two reporting periods, the 9.60 million shares sold short still account for 6% of the stock’s available float, or over one week’s worth of pent-up buying power.

Additional tailwinds could come from a sentiment shift in the options pits. The security’s Schaeffer’s put/call open interest ratio (SOIR) of 0.89 ranks in the 96th percentile of its annual range, indicating short-term options traders have rarely been more put-biased.

Now seems like an excellent opportunity to speculate on the security’s next moves with options, per Acadia Pharmaceuticals stock’s Schaeffer’s Volatility Index (SVI) of 49%, which sits in the extremely low 2nd percentile of its annual range. In other words, options traders are pricing in relatively low volatility expectations for the equity right now.

Image and article originally from www.schaeffersresearch.com. Read the original article here.