The proponents of Bitcoin (BTC) and other cryptocurrencies have long argued that it is like gold, serving as another venue for storing your wealth and not having it subject to the vicissitudes of fiat currencies. They also argue that it is a great medium of exchange, although that latter part still really has not taken off yet.

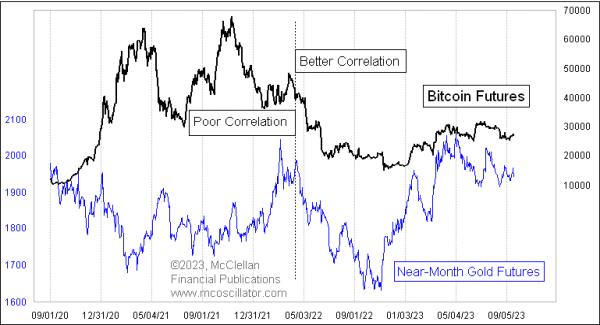

The curious point about this comparison of Bitcoin to gold, as another currency alternative, is that, prior to 2022, the value of Bitcoin and the price of gold were not very well correlated. In fact, one could justifiably argue that there was an inverse correlation back in 2020 and 2021. That changed beginning in April 2022, when Bitcoin prices suddenly started correlating positively to gold prices. I do not have a good explanation for why that was a crucial moment. It was not a Bitcoin “halving” date, as the last one of those was May 11, 2020. But something has changed to cause a shift in behavior.

Now, gold prices and Bitcoin are marching in step together. Presumably this means that whatever is bullish for gold is now bullish for Bitcoin, and vice versa.

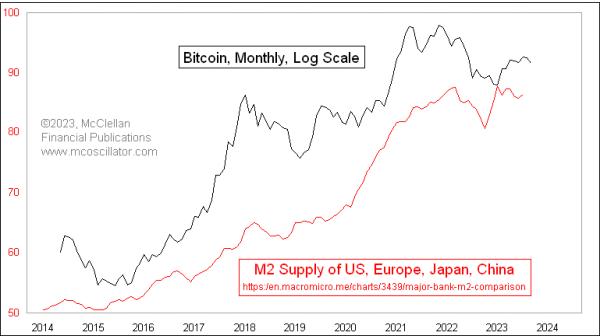

One factor that has not changed yet is the relationship shown in the next chart. It compares monthly Bitcoin prices to a composite M2 measure, combining the 4 largest world economic and currency blocks.

Bitcoin rode the wave of global currencies expanding their supply from 2015-2021. We can see that Bitcoin started to stumble back in 2021-22, when global M2 started to level off. If we ever see another case of world central banks deciding to throw money at a problem like they did for COVID back in 2020, then we can reasonably expect Bitcoin values to surge once again. And now, that presumably would apply to gold too, given their new relationship. Or, if the decline in M2 being led by the US Federal Reserve perpetuates to other major currencies, then that would be bearish for both gold and Bitcoin.

By itself, this revelation about Bitcoin now acting like gold prices does not really tell us what is next for either Bitcoin or gold. But it is still important to recognize that the rules of interaction between those markets have changed.