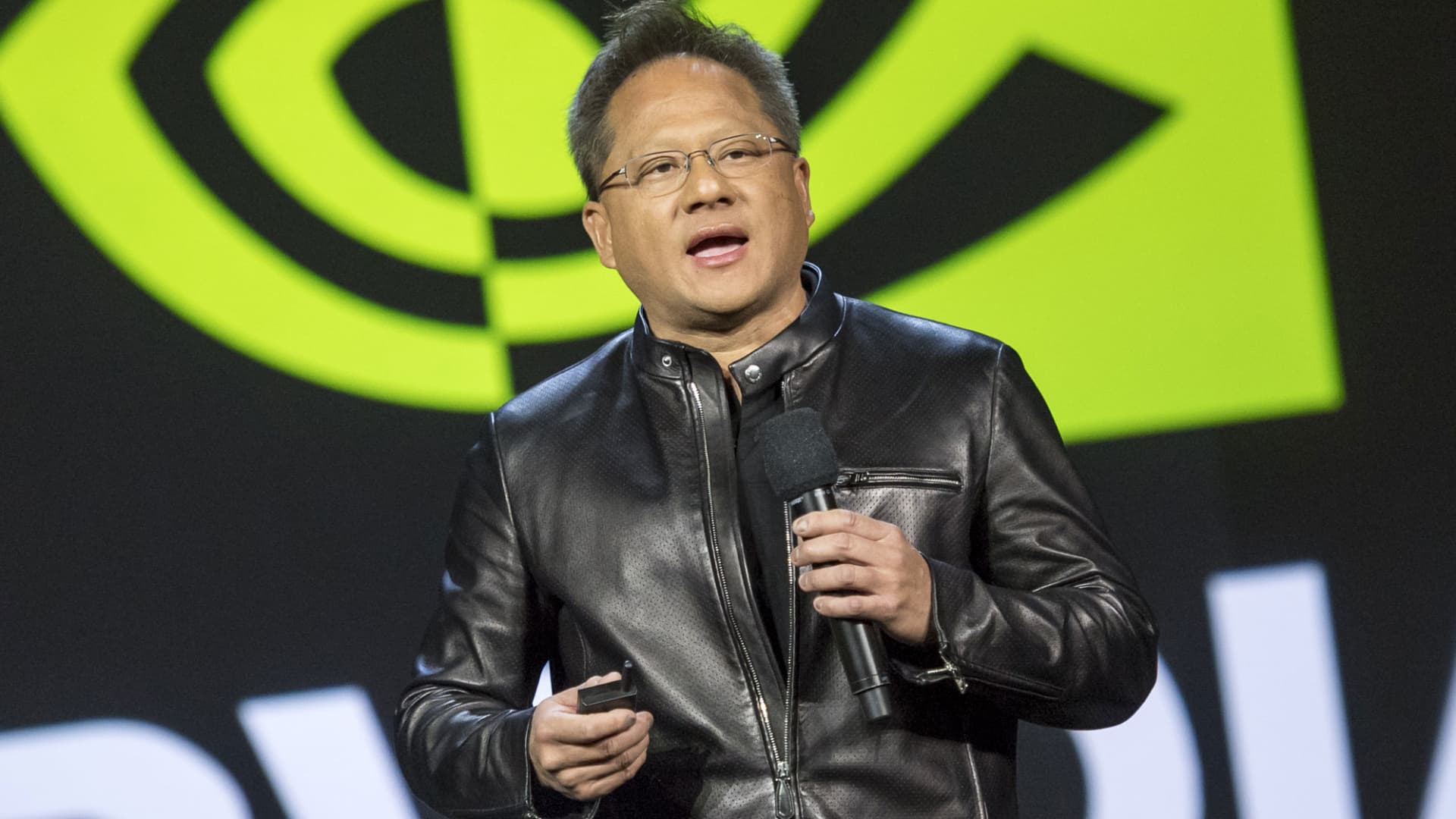

Jen-Hsun Huang, CEO, Nvidia.

David Paul Morris | Bloomberg | Getty Images

Check out the companies making headlines in the premarket.

Nvidia — The chipmaker popped 7% after reporting another blowout quarter that topped Wall Street’s estimates. Nvidia also offered optimistic guidance, saying sales will jump 170% during the current period as demand for artificial intelligence chips continues to gain steam. Adjusted earnings came in at $2.70 per share, ahead of the $2.09 estimate expected from analysts polled by Refinitiv. Nvidia reported revenue of $13.51 billion, topping the $11.22 billion expected by Wall Street.

Taiwan Semiconductor, AMD, Marvell Technology — Semiconductor stocks tied to artificial intelligence and Nvidia rose in the premarket on the back of another strong earnings report from the AI chip giant. Advanced Micro Devices, Marvell Technology and U.S.-listed shares of Taiwan Semiconductor rose 2.3%, 4.2% and 3.1%, respectively. Broadcom and Super Micro Computer added 3.4% and 8.5%, respectively.

Boeing — Shares lost about 2% before the bell after Boeing revealed a new manufacturing defect involving supplier Spirit AeroSystems that will delay 737 Max deliveries. The company said fastener holes were improperly drilled on some of the model’s aft pressure bulkheads. Spirit AeroSystems shed more than 6%.

Splunk — The stock gained 13.6% after Splunk reported an earnings beat. The cloud services provider earned 71 cents per share, after adjustments, on $910.6 million in revenue for the second quarter. Analysts surveyed by FactSet had expected Splunk would earn 46 cents per share and $889.3 million in revenue. The company also raised its guidance.

Snowflake — Shares of the cloud company jumped 3.5% on the back of its earnings report. Snowflake posted 22 cents in adjusted earnings per share on $674 million in revenue. Analysts polled by Refinitiv had estimated 10 cents in earnings per share on $662 million in revenue.

Dollar Tree — The discount retailer’s stock dipped more than 6% in premarket trading after Dollar Tree’s third-quarter earnings guidance came in well below expectations. The company said it expected between 94 cents and $1.04 in earnings per share for the current quarter, while analysts were looking for $1.27 per share, according to Refinitiv. Dollar Tree’s second-quarter results did top estimates on the top and bottom lines.

Guess — Shares surged more than 16% after the apparel company on Wednesday reported adjusted earnings of 72 cents per share on revenue of $664.5 million in the second quarter. CEO Carlos Alberini said, “Our international businesses continued to perform strongly with robust revenue growth,” and cited “strong gross margin” and “effective cost management” in the quarter.

Autodesk — Shares rose more than 6% after the software company reported stronger-than-expected quarterly results and third-quarter guidance. Autodesk reported adjusted earnings of $1.91 per share on $1.35 billion in revenue. That came in ahead of the EPS of $1.73 on revenue of $1.32 billion expected by analysts polled by Refinitiv.

Petco Health and Wellness — The pet-care retailer tumbled more than 10% after reporting second-quarter earnings before the bell. Adjusted earnings per share of 6 cents was in line with expectations and revenue slightly beat estimates, per StreetAccount. However, Petco’s full-year guidance for adjusted EPS and adjusted earnings before interest, taxes, depreciation and amortization fell short of consensus estimates.

— CNBC’s Hakyung Kim, Pia Singh, Sarah Min, Michelle Fox and Jesse Pound contributed reporting.

Image and article originally from www.cnbc.com. Read the original article here.