Darden Restaurants will acquire the parent of Ruth’s Chris Steak House

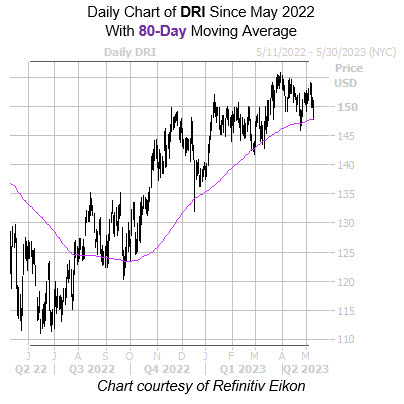

Darden Restaurants, Inc. (NYSE:DRI) stock is down 1.5% at $148.10 at last check, after news the company will acquire the parent of Ruth’s Chris Steak House for $715 million. This negative price action isn’t likely to last, though, as a pullback from the $154 area has placed DRI near a trendline that has generated tailwinds in the past. While the security already sports a 16.9% year-over-year lead, a rally would help it build upon its 7.1% gain for 2023.

Options bulls seem to be in on the secret, as there’s been an appetite for calls lately. This is per DRI’s 50-day call/put volume ratio of 2.13 over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks higher than all readings from the last 12 months.

Weighing on the stock’s next moves with options could be an excellent idea, given its Schaeffer’s Volatility Index (SVI) of 20% stands in the low 4th percentile of readings from the past year. This means premiums are affordably priced right now.

Image and article originally from www.schaeffersresearch.com. Read the original article here.