Fintel reports that on May 10, 2023, Needham reiterated coverage of Comscore (NASDAQ:SCOR) with a Buy recommendation.

Analyst Price Forecast Suggests 157.55% Upside

As of May 11, 2023, the average one-year price target for Comscore is 2.21. The forecasts range from a low of 1.01 to a high of $3.15. The average price target represents an increase of 157.55% from its latest reported closing price of 0.86.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Comscore is 399MM, an increase of 6.65%. The projected annual non-GAAP EPS is -0.27.

What is the Fund Sentiment?

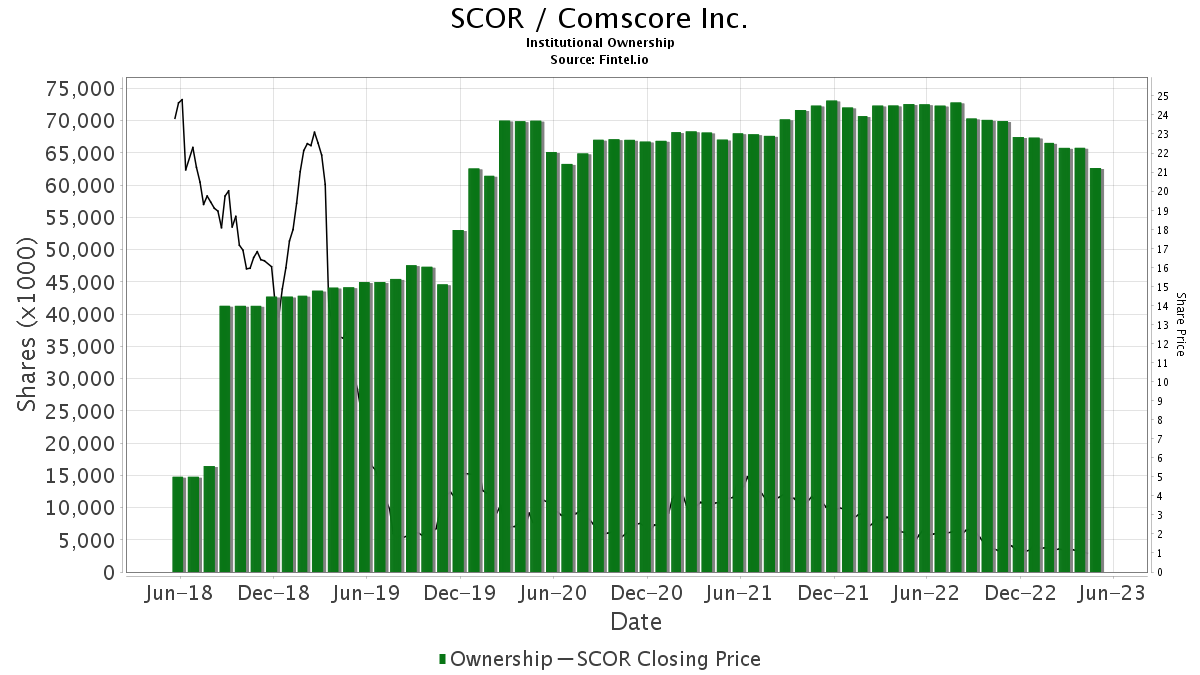

There are 159 funds or institutions reporting positions in Comscore. This is an increase of 2 owner(s) or 1.27% in the last quarter. Average portfolio weight of all funds dedicated to SCOR is 0.15%, a decrease of 21.73%. Total shares owned by institutions decreased in the last three months by 2.97% to 61,729K shares. The put/call ratio of SCOR is 0.00, indicating a bullish outlook.

What are Other Shareholders Doing?

Weiss Multi-Strategy Advisers holds 9,023K shares representing 9.72% ownership of the company. In it’s prior filing, the firm reported owning 8,582K shares, representing an increase of 4.89%. The firm decreased its portfolio allocation in SCOR by 20.71% over the last quarter.

Westerly Capital Management holds 4,380K shares representing 4.72% ownership of the company. In it’s prior filing, the firm reported owning 3,390K shares, representing an increase of 22.60%. The firm decreased its portfolio allocation in SCOR by 16.95% over the last quarter.

180 Degree Capital holds 3,909K shares representing 4.21% ownership of the company. In it’s prior filing, the firm reported owning 2,763K shares, representing an increase of 29.32%. The firm increased its portfolio allocation in SCOR by 27.57% over the last quarter.

Primecap Management holds 2,883K shares representing 3.11% ownership of the company. In it’s prior filing, the firm reported owning 5,272K shares, representing a decrease of 82.83%. The firm decreased its portfolio allocation in SCOR by 63.62% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 2,443K shares representing 2.63% ownership of the company. No change in the last quarter.

Comscore Background Information

(This description is provided by the company.)

Comscore is a trusted partner for planning, transacting and evaluating media across platforms. With a data footprint that combines digital, linear TV, over-the-top and theatrical viewership intelligence with advanced audience insights, Comscore allows media buyers and sellers to quantify their multiscreen behavior and make business decisions with confidence. A proven leader in measuring digital and TV audiences and advertising at scale, Comscore is the industry’s emerging, third-party source for reliable and comprehensive cross-platform measurement.

See all Comscore regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.