Upbeat early-stage trial data and a revenue win are boosting VRDN

The shares of Viridian Therapeutics Inc (NASDAQ:VRDN) are up 59.5% at $23.50 at last check, despite the company reporting wider-than-expected second-quarter losses of $1.06 per share. Boosting the equity instead is a quarterly revenue win, as well as news that an early-stage trial of antibody candidate, VRDN-001, in patients with active thyroid eye disease (TED) showed significant and rapid improvement in both signs and symptoms.

In response, SVB raised the stock’s price target to $40 from $36. Firms are extremely bullish towards VRDN, with all nine in coverage calling it a “strong buy.” Meanwhile, the 2.62 million shares sold short make up 10.2% of its available float, or over one week’s worth of pent-up buying power. Should shorts start hitting the exits, VRDN may surge even higher.

Overall options volume is already running at 29 times what is typically seen at this point, with 2,253 calls and 5,637 puts across the tape so far. Most popular is the August 2.50 put — where positions are currently being opened — followed by the 22.50 call in the same monthly series.

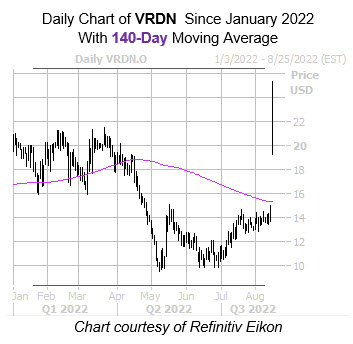

Today’s bull gap has shares trading at their highest level since January 2021. The equity earlier blasted through a ceiling at the 140-day moving average, staging an impressive bounce off the $13.50 region, as it eyes a fourth-straight daily win. Quarter-to-date, VRDN has added 103.6%.

Image and article originally from www.schaeffersresearch.com. Read the original article here.