Call volume is running at 3 times the intraday average

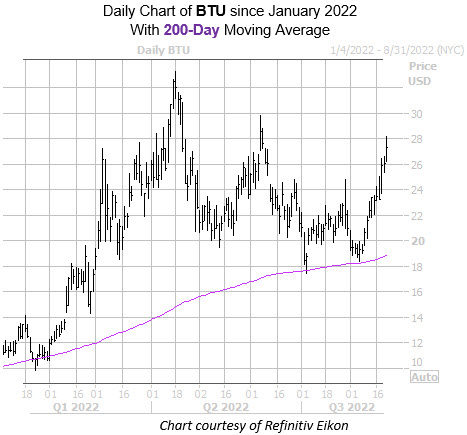

Peabody Energy Corp (NYSE:BTU) is receiving plenty of bullish options attention today as the stock climbs on the charts — up 5% at $27.23 at last glance. Already up 171.5% year-to-date, BTU has found a floor just above the $18 level, which is also home to the supportive 200-day moving average.

So far today, 28,000 calls have crossed the tape, which is three times the intraday average and over seven times the amount of puts exchanged. The September 30 call is the most popular by far, with new positions being bought to open there.

This penchant for calls has been the norm lately, as per Peabody Energy stock’s 50-day call/put volume ratio of 8.25 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks higher than 95% of readings from the past year.

These options are cheap at the moment, too. BTU’s Schaeffer’s Volatility Index (SVI) of 77% stands higher than just 4% of all other readings in its annual range, implying that options players are pricing in low volatility expectations at the moment.

Meanwhile, short interest has been on the rise lately, up 15.4% in the last month. Now, the 16.36 million shares sold short account for a hefty 11.5% of the stock’s available float.

Image and article originally from www.schaeffersresearch.com. Read the original article here.