Lucid Group filed for a mixed shelf offering of up to $8 billion

Lucid Group Inc (NASDAQ:LCID) stock is sinking today, after the electric vehicle (EV) maker filed for a mixed shelf offering of up to $8 billion. Supply chain and logistics issues have put pressure on production, and the company is hoping to increase its working capital. At last glance, LCID was down 6.8% to trade at $15.07.

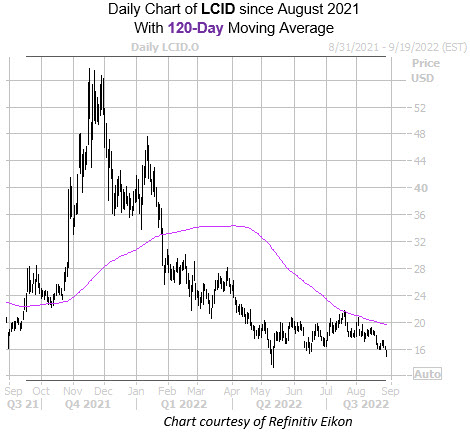

Earlier trading as low as $14.89, today’s drop has Lucid Group stock moving back toward its May 12 one-year low of $13.25. Overhead pressure at the 120-day moving average has been guiding the stock lower, too. Year-to-date, the equity is down 60.5%.

The options pits have been bullish toward LCID, and some of that optimism could start to unwind. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 2.84 calls have been bought for every put in the last two weeks. This ratio ranks in the slightly elevated 75th percentile of its annual range, showing calls being picked up at a relatively fast rate in comparison to the past year.

Meanwhile, though shorts have been tepidly buying back their bearish bets, short interest still makes up 7.6% of the stock’s available float. It would take seven days to cover, at LCID’s average pace of trading.

Image and article originally from www.schaeffersresearch.com. Read the original article here.