NetApp will report earnings after the close tomorrow, Aug. 24

Earnings reports are continuing to trickle in, and now investors are looking ahead to a fiscal first-quarter turnout from software concern NetApp Inc. (NASDAQ:NTAP), which will be due out out after the close tomorrow, Aug. 24. At last check, NTAP was up 1% at $73.77. Below, we’ll take a look at the stock’s recent performance, as well as its past post-earnings activity.

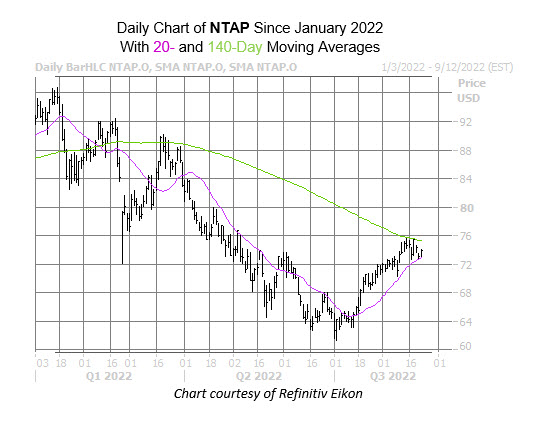

The equity is currently cooling from rally that lasted for most of the third quarter, with NTAP eventually losing steam at the 140-day moving average — a trendline that also snuffed out a rally in the first quarter of 2022. The stock’s 20-day moving average has helped keep some of this pullback in check, however, leaving the stock with a 13.3% quarter-to-date lead. Year-to-date, NTAP is still down 19.7%.

Looking back over the last two years’ worth of earnings reports, NTAP has seen positive next day returns after six of these instances, falling lower twice, which includes a 14.5% post-earnings plummet in February 2021. Regardless of direction, NetApp stock has averaged a next-day swing of 5.2%. This time, the options pits are pricing in a 9.6% move.

NetApp’s options pits lean bullish right now. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock sports a 50-day call/put volume ratio of 1.27, which sits higher than all but 2% of annual readings. In other words, there’s been a healthier-than-usual appetite for long calls of late.

Meanwhile, are mostly optimistic, but there’s still room for post-earnings bull notes. Of the 17 in coverage, seven still call NTAP a “hold,” while the 12-month consensus price target of $86.67 is a 17.3% premium to current levels.

Image and article originally from www.schaeffersresearch.com. Read the original article here.