META has so far bucked the trend with a strong February stock performance

Subscribers to Chart of the Week received this commentary on Sunday, January 29.

Layoffs have rocked the tech sector for the last year. ‘Disruptive’ companies that could seemingly do no wrong leading up to the Covid pandemic found themselves laying off sizable chunks of their workforce as revenue growth slowed. It’s left a gruesome scene around Big Tech. Until the dust settles, two “FAANG” stocks – should they be called MAANG now? Or MANGA?! — at the forefront of the layoff drama should be on your radar, but for vastly different reasons.

While Meta Platforms Inc (NASDAQ:META) has added 69% off Nov. 4 seven-year lows of $88.09, the shares have run right into their -50% year-over-year level, and just above that, their 200-day moving average. This area also coincides with the $400 billion market cap level, the site of 2018 and Covid lows.

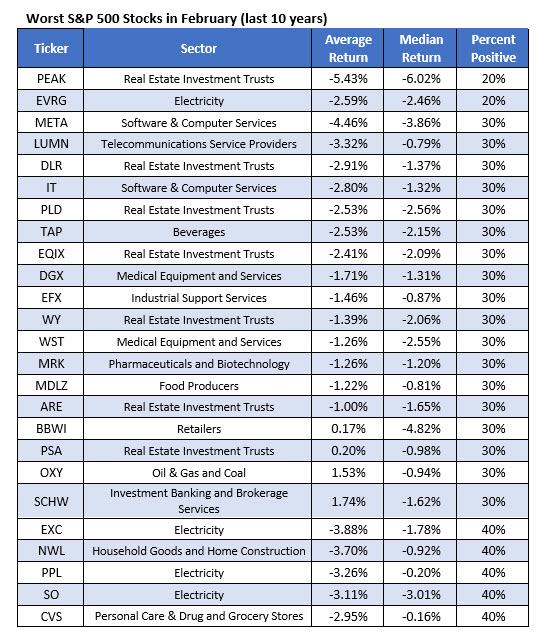

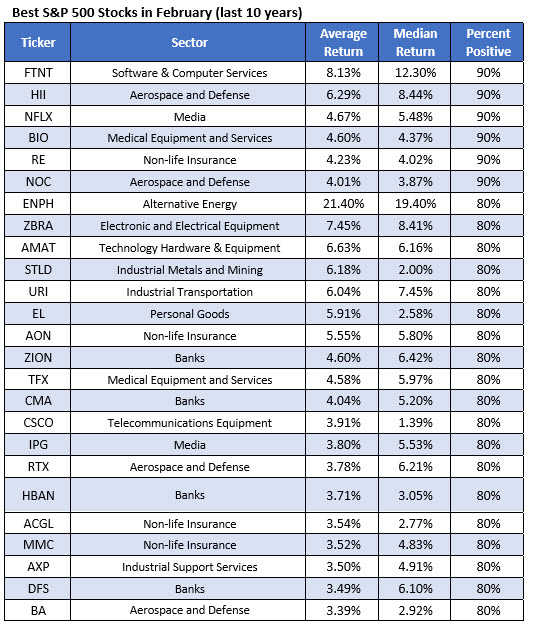

It could get worse before it gets better, as META also historically underperforms in February. According to Schaeffer’s Senior Quantitative Analyst Rocky White, below are the 25 best S&P 500 Index (SPX) stocks to own in February, looking back 10 years. META is second worst on the list, ending the month higher only 30% of the time with an average return of -4.5%.

Why such underperformance in February? Probably earnings. The house Zuckerberg built reports fourth-quarter earnings after the market closes on Wednesday Feb. 1, and META has a history of less-than-stellar post-earnings reactions. Six of the last eight reports have been followed by a downside move, including a 24.6% bear gap in late October, as well as a 26.4% drawdown last February. Overall, the equity averages a post-earnings move of 11.5%, and the options market is pricing in a similar move of 12.8% for Thursday’s trading. Should META suffer another post-earnings bear gap, the 23 of the 36 brokerages in coverage that maintain “strong buy ” ratings could be compelled to shift their stance, which would cloud the technical picture even more.

Along with Meta, streaming giant Netflix Inc (NASDAQ:NFLX) was one of the first tech behemoths to begin the layoff process, announcing a 3% reduction back in July. At that time, NFLX was consolidating near its May 12 five-year lows of $162.71. The shares have since tacked on 123% from that bottom, and on Monday gapped past their 320-day moving average for the first time since early January 2022. The equity also reclaimed its year-over-year breakeven level as well as the $150 billion market cap level, the latter of which is half its all-time market cap level of $300 billion. Note the purple trendline drawn below, the channel of higher highs carved from that May bottom.

Netflix has already been in the earnings confessional, gapping higher by 8.5% last week on Jan. 19 amid encouraging subscriber numbers. With that potentially volatile hurdle in the rearview mirror, NFLX is entering a historically bullish month. Per White’s list of best 25 SPX stocks to own in February, Netflix tops the list, ending the month higher 90% of the time with an average return of 4.7%.

While META and NFLX are flashing very different signals entering February, put traders are crowding both stocks. Their respective 50-day put/call volume ratios at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) rank in the 96th percentile or higher of their annual range, indicating an unusually heavy appetite for long puts of late. Whichever stock you choose to target in February, options are a safe route right now. META’s Schaeffer’s Volatility Scorecard (SVS) checks in at 91 (out of 100), while NFLX’s sits at 75, indicating both shares have shown a tendency to make big moves in the past year, per their volatility expectations.

Image and article originally from www.schaeffersresearch.com. Read the original article here.