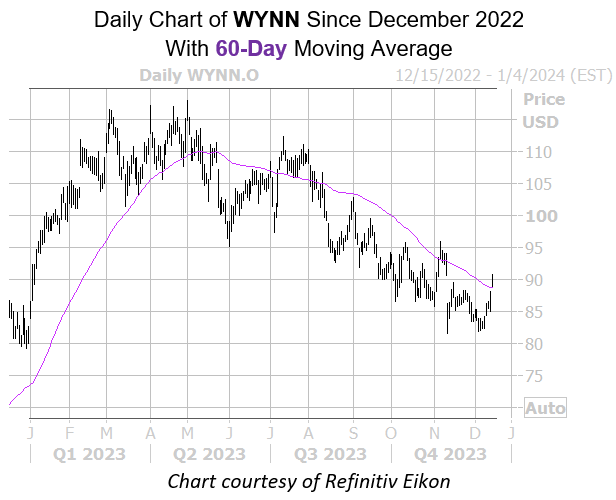

WYNN just pulled back to a historically bearish signal on the charts

Wynn Resorts Ltd (NASDAQ:WYNN) is on track for its seventh-straight daily gain, up 2.9% at $90.53 despite a price-target cut from J.P. Morgan Securities to $104 from $120. The stock could continue chopping lower, however, as it has since early August, given a bear signal flashing on the charts.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, WYNN has come within one standard deviation of its 60-day moving average for the eighth time in the last three years. Following the previous signals, the stock was lower one month later 57% of the time, averaging a 9.2% loss.

When speculating on Wynn Resorts stock, now looks like a good time to weigh in with puts. The security’s Schaeffer’s Volatility Index (SVI) of 29% ranks in the low 9th percentile of its annual range, meaning options traders are pricing in low volatility expectations at the moment.

Image and article originally from www.schaeffersresearch.com. Read the original article here.