UAL just ran into a historically bearish trendline on the charts

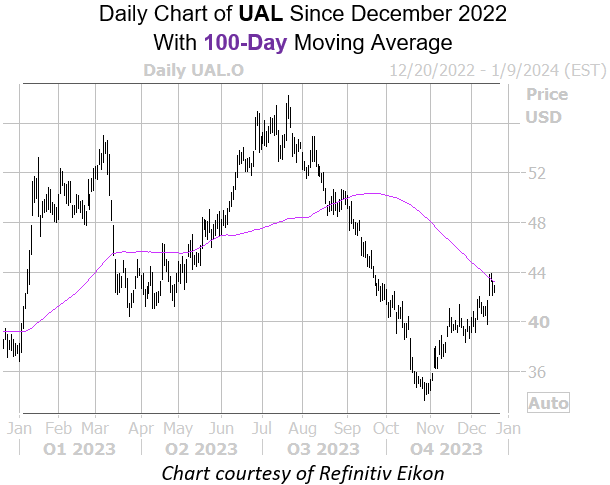

United Airlines Holdings Inc (NASDAQ:UAL) stock has been climbing overall since its Oct. 27, 52-week low of $33.68, closing six of the last seven weeks with gains. The $44 level appears to have moved in as pressure, however, and the stock could be due for a short-term dip.

UAL was last seen down 0.2% to trade at $42.25, and is currently within one standard deviation of its 100-day moving average, a trendline with historically bearish implications. According to Schaeffer’s Senior Quantitative Analyst Rocky White, United Airlines stock has seen five similar signals in the past three years, and was lower one month later in 80% of those instances, averaging a 6.1% loss.

A round of bear notes could provide headwinds as well. Of the 16 analysts covering UAL, 12 carry a “buy” or better rating, while the 12-month consensus price target of $59.59 sits at a 41% premium to current levels.

Image and article originally from www.schaeffersresearch.com. Read the original article here.