A short squeeze could keep tailwinds blowing

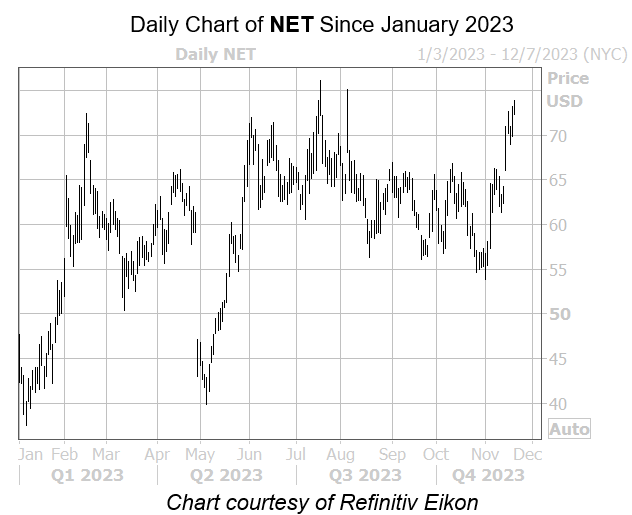

Cloudflare Inc (NYSE:NET) is today trading at its highest level since early August, last seen up 0.3% at $72.94 at last glance. The security also sports a 61.7% year-to-date lead, and is pacing for its sixth daily gain over the last seven. With help from historically bullish signal now flashing, the equity could have just what it needs to keep charging higher, too.

This is currently the case with the stock’s SVI of 45%, which stands in the 1st percentile of annual readings. The shares were higher one month later after each of those signals, averaging a 16.4% rise. From its current level, a move of similar magnitude would place NET above $48, or its highest level since February 2022.

A short squeeze could accelerate these gains. Short interest rose 4% in the most recent reporting period, and the 19.64 million shares sold short make up 6.7% of the security’s available float. It would take shorts more than one week to cover their bearish bets, at NET’s current pace of trading.

Image and article originally from www.schaeffersresearch.com. Read the original article here.