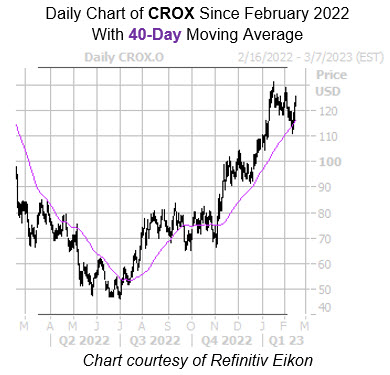

If past is precedent, CROX has an excellent chance of bouncing off a bullish trendline

Crocs, Inc. (NASDAQ:CROX) is up 1.8% at $124.58 at last check, brushing off today’s broader market headwinds. The security will report fourth-quarter earnings before the opening bell tomorrow, with analysts anticipating profits of $2.26 per share. The shares have cooled from a Jan. 18, one-year high of $131.17, but added 124.7% over the last nine months, and could surge even higher now are near a historically bullish trendline.

Digging deeper, CROX stock has just pulled back to its 40-day moving average. Per Schaeffer’s Senior Quantitative Analyst Rocky White’s latest study, the equity saw six similar signals in the last three years, and was higher one month later 83% of the time, averaging an 11.3% gain. A comparable move from the security’s’ current perch would place it at a fresh one-year peak of $138.65.

As far as post-earnings reactions are concerned, Crocs stock has a mixed history. The shares have finished half of these next-day sessions higher, and the other half lower, but added 14.2% following their November report. Over the past two years, CROX averaged a move of 9.8%, regardless of direction, but the options pits are pricing in a much bigger-than-usual swing of 15.2% this time around.

Options traders are already chiming in, with 8,138 and 9,693 puts across the tape so far today, or quadruple the intraday average volume. The most popular contracts are the February 130 and 145 calls, where positions are being opened.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity’s 50-day put/call volume ratio sits higher than 95% of annual readings, indicating long puts have been more popular than usual of late.

While short sellers are hitting the exits, with short interest down 8.1% in the last two reporting periods, the 5.40 million shares sold short still account for 9% of CROX’s available float.

Image and article originally from www.schaeffersresearch.com. Read the original article here.