Biomea Fusion Inc BMEA shares are trading higher. The company reported fourth-quarter results after the bell and announced an offering Wednesday morning. Several analysts are out with positive coverage.

What Happened: Biomea reported a fourth-quarter loss of 86 cents per share, which missed average analyst estimates for a loss of 81 cents per share. The company ended the quarter with $113.4 million in cash.

Following the report, Biomea announced a public offering of $125 million of its common stock.

The news comes after the company early Tuesday announced data from the initial cohorts of the ongoing Phase II study of BMF-219 in patients with type 2 diabetes.

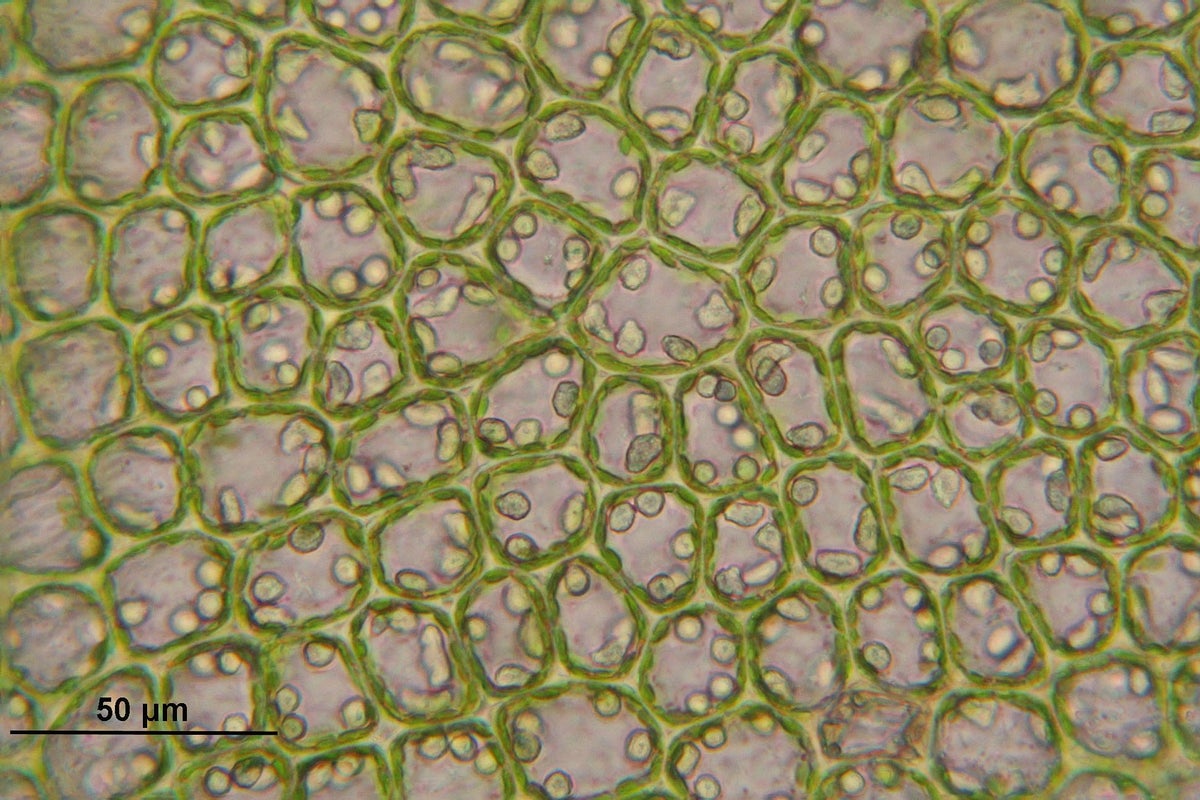

“Our goal with BMF-219 is to deliver the first disease-modifying treatment for patients with diabetes by addressing the root biological cause of the disease and its inevitable progression: the loss of insulin-producing beta cells,” said Thomas Butler, chairman and CEO of Biomea Fusion.

The Biomea CEO noted that the company is “seeing indications” that it’s achieving its goal after the study showed that 89% of patients achieved a reduction in A1c.

See Also: Why Emergent Biosolutions Stock Is Surging Today

Analyst Assessment: Several analysts raised price targets on the stock over the last two days.

- Piper Sandler analyst Joseph Catanzaro maintained Biomea with an Overweight and raised the price target from $16 to $40.

- EF Hutton analyst Michael King maintained Biomea with a Buy and raised the price target from $22 to $33.

- HC Wainwright & Co. analyst Joseph Pantginis reiterated Biomea with a Buy and raised the price target from $37 to $44.

- Citigroup analyst Yigal Nochomovitz maintained Biomea with a Buy and raised the price target from $20 to $60.

- Oppenheimer analyst Hartaj Singh maintained Biomea with an Outperform and raised the price target from $25 to $47.

BMEA Price Action: Biomea shares were up 13.9% at $34.97 at the time of publication, according to Benzinga Pro.

Photo: WikimediaImages from Pixabay.

Image and article originally from www.benzinga.com. Read the original article here.