Fintel reports that on May 25, 2023, Wells Fargo upgraded their outlook for Dycom Industries (NYSE:DY) from Equal-Weight to Overweight .

Analyst Price Forecast Suggests 32.17% Upside

As of May 11, 2023, the average one-year price target for Dycom Industries is 128.23. The forecasts range from a low of 106.05 to a high of $152.25. The average price target represents an increase of 32.17% from its latest reported closing price of 97.02.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Dycom Industries is 4,115MM, an increase of 8.05%. The projected annual non-GAAP EPS is 5.47.

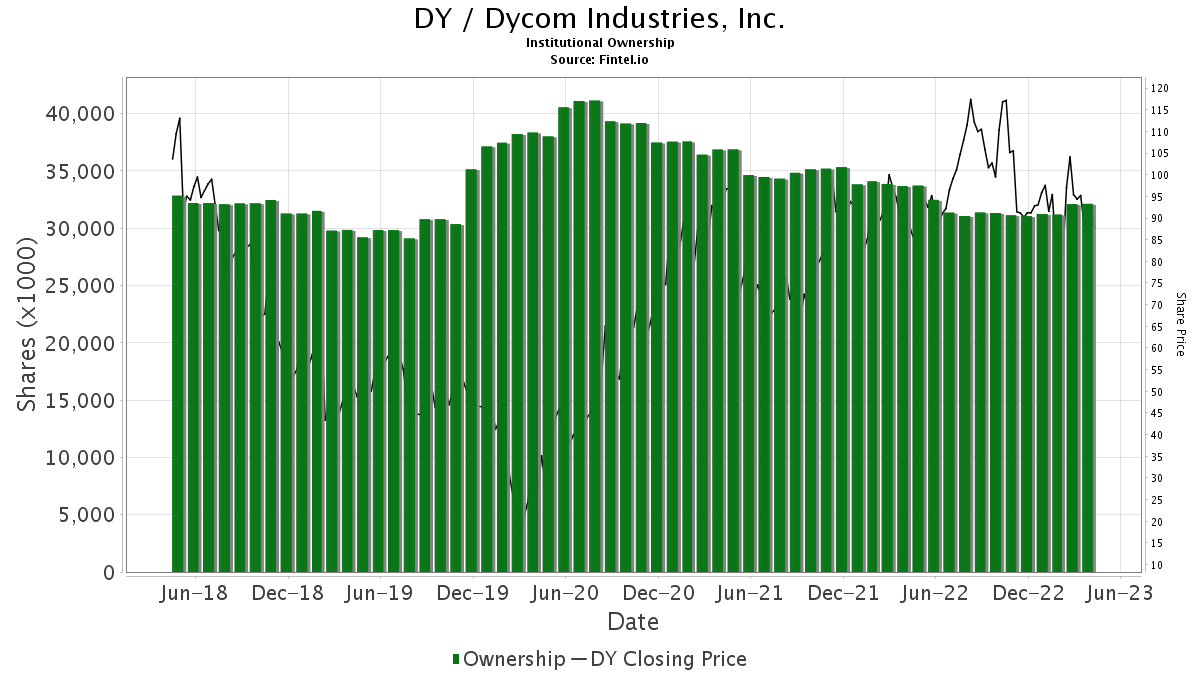

What is the Fund Sentiment?

There are 626 funds or institutions reporting positions in Dycom Industries. This is an increase of 4 owner(s) or 0.64% in the last quarter. Average portfolio weight of all funds dedicated to DY is 0.29%, a decrease of 6.72%. Total shares owned by institutions increased in the last three months by 1.27% to 32,599K shares. The put/call ratio of DY is 0.86, indicating a bullish outlook.

What are Other Shareholders Doing?

Peconic Partners holds 2,690K shares representing 9.16% ownership of the company. In it’s prior filing, the firm reported owning 2,520K shares, representing an increase of 6.34%. The firm decreased its portfolio allocation in DY by 6.06% over the last quarter.

Alliancebernstein holds 2,174K shares representing 7.41% ownership of the company. In it’s prior filing, the firm reported owning 1,729K shares, representing an increase of 20.49%. The firm increased its portfolio allocation in DY by 1.40% over the last quarter.

IJR – iShares Core S&P Small-Cap ETF holds 2,156K shares representing 7.34% ownership of the company.

Principal Financial Group holds 1,140K shares representing 3.88% ownership of the company. In it’s prior filing, the firm reported owning 1,044K shares, representing an increase of 8.44%. The firm decreased its portfolio allocation in DY by 41.14% over the last quarter.

IJH – iShares Core S&P Mid-Cap ETF holds 910K shares representing 3.10% ownership of the company. In it’s prior filing, the firm reported owning 863K shares, representing an increase of 5.17%. The firm decreased its portfolio allocation in DY by 9.82% over the last quarter.

Dycom Industries Background Information

(This description is provided by the company.)

Dycom is a leading provider of specialty contracting services throughout the United States. These services include program management; planning; engineering and design; aerial, underground, and wireless construction; maintenance; and fulfillment services for telecommunications providers. Additionally, Dycom provides underground facility locating services for various utilities, including telecommunications providers, and other construction and maintenance services for electric and gas utilities.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.