Artificial intelligence (AI) is Wall Street’s first buzz word for 2023

Subscribers to Chart of the Week received this commentary on Sunday, February 12.

If you’re still smarting from the tech sector selloff of 2022, you wouldn’t be blamed for suspicion toward generative artificial intelligence (AI), Wall Street’s first buzz word of 2023. The sudden reversal of meme stocks through 2020-2021 should still be fresh in investors’ minds, not to mention every other fad in the last three decades—how is the Metaverse doing? Web3? But its investor malpractice to at least not give every fad some level of due diligence, to kick the tires. AI stocks must also be put under the microscope.

The meme stock, crypto, and metaverse crazes were fueled by rampant speculation on the margins. The survival and implantation of ‘The Next Big Thing’ ultimately comes down to tangible value, and you can’t deny that billions of people use search engines every day. The fact that Big Tech is locked in an AI arms race should signal that AI could be different from previous flavors of the week. Microsoft (MSFT) has invested billions of dollars in OpenAI, the natural language AI tech company behind ChatGPT. The devil works fast, but Bill Gates works faster; earlier this week, Microsoft unveiled an overhauled version of its Bing search engine, featuring a more souped up large language model than ChatGPT. MSFT added 1.5% this week, reclaiming the $2 trillion market cap level in the process.

Alphabet (GOOGL), fearing competition to the ubiquitous Google, responded with a demo of Bard, its own software version of ChatGPT. However, glitches marred the debut, resulting in GOOGL shedding 7.7% on Feb. 8. But with one of the largest AI research departments on the planet, don’t count Alphabet out for long. This is a company that pivoted to generative AI over six years ago; they are still the trailblazers. Jeff Bezos gets FOMO more than anyone, so you can’t disregard Amazon.com (AMZN). Tesla (TSLA) announced an AI robot at its company day last September to much derision. You know Elon Musk isn’t done there, if he can just get out of his own way.

To underscore just how much of a sleeping giant AI is, consider this stat from Precedence Research: “The global artificial intelligence (AI) chip market size was evaluated at USD 16.86 billion in 2022 and it is expected to hit around USD 227.48 billion by 2032, expanding at a CAGR of 29.72% from 2023 to 2032.” Like most disruptive technologies in their infancy, the buzz will eventually die down after the initial craze has cycled through the media. But if you’re long-term bullish on AI, any Big Tech stock with a stable valuation and fundamentals is worth a long look once the initial buzz dies down.

Like the internet in the early ‘90s, AI has the potential to be a paradigm shift for any tech company; you’re either making inroads with it or at risk of being left behind. Just ask Borders, which launched its own online business to compete with AMZN in a way-too-late 2008. It seems companies have learned their lesson because there are plenty of other companies to monitor. Over in China, Alibaba (BABA) and Baidu (BIDU) posted weekly gains of xx and xx respectively, after announcing their own AI bots. Palantir (PLTR) is a big player in the Big Data sector. IBM’s (IBM) Watson — introduced way back in 2010 — will likely get a facelift.

Semiconductor stocks like Micron Technology (MU) and Nvidia stand to benefit from widespread implementations of AI, since chips are the engine that powers the AI machine. Right now, programs like ChatGPT are burning through computer power. Per Tech Monitor: “A large language model such as GPT-3 requires a significant amount of energy and computing power for its initial training. This is in part due to the limited memory capacity of even the largest GPUs used to train the systems, requiring multiple processors to be running in parallel.” In other words, as semiconductors go, so too does AI. Companies that utilize machine learning like DocuSign (DOCU), Oracle (ORCL), Cloudflare (NET), and Snowflake (SNOW) also stand to benefit from AI developments in cybersecurity and cloud sectors. Investing in any of the above companies is a savvy way to take a flier on AI without overcommitting.

In the shorter term, there are some specialized AI stocks out there with lingering upside right now. C3.ai (AI) has added roughly 107% in 2023 alone, yet still has 9.1% of its total available float sold short and nine of 11 analysts rate the stock a “hold” or worse. Canaccord Genuity just initiated coverage on SentinelOne (S) with a “buy” rating and $20 price target, yet a healthy 8.3% of S’ total available float is sold short. Penny stocks SoundHound AI (SOUN) and BigBear.ai (BBAI) are two other names to watch, the latter of which secured a $900 million pact from the Air Force last month.

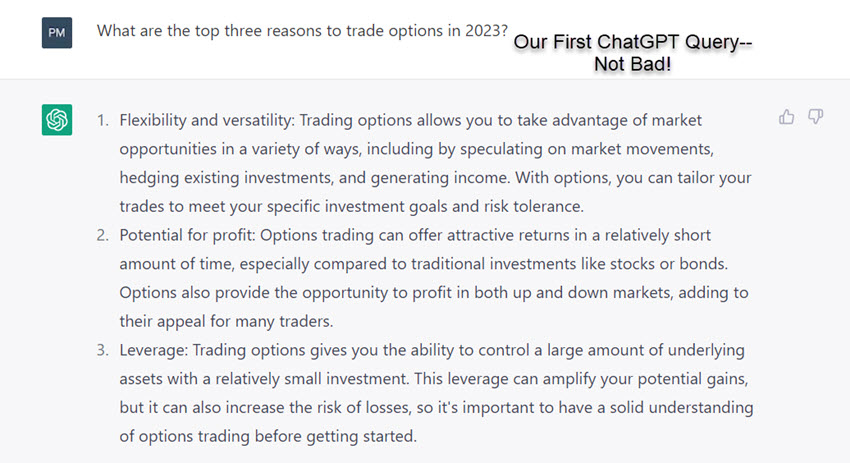

Google Trends shows ‘AI’ search terms steadily grew through 2022 and exploded in 2023, but the technology behind generative AI is still very much at the ground floor. Eager to test it out ourselves, below are the results after asking ChatGPT about the benefits of options trading (attempts at getting ChatGPT to predict the Super Bowl or Waste Management Open winner proved futile). Emboldened by a decent response, I then asked ChatGPT to write a haiku about options trading, and that’s where the train went off the tracks, per below. A quick refresh produced a haiku, albeit a rather lame one. The whole experiment was a stark reminder that while AI presents some exciting opportunities for investors, its global impact still has a long way to go.

FREE: Schaeffer’s Top 2023 Stock Picks!

Schaeffer’s Market Mashup Podcast: Threading the Needle With Joe Hargett

Image and article originally from www.schaeffersresearch.com. Read the original article here.