The security is running into a historically bearish trendline

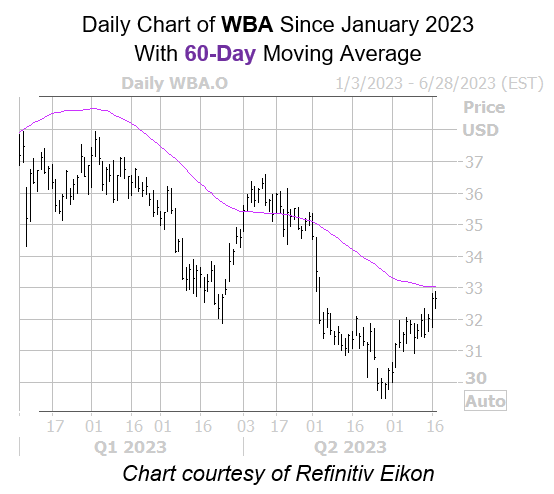

Walgreens Boots Alliance Inc (NASDAQ:WBA) stock is flat today, last seen trading at $32.67, as the Dow Jones Industrial Average (DJIA) paces for its worst drop since early May. The security recently bounced off a May 26, 11-year low of $29.48, but still carries a 12.5% deficit for 2023, which may soon get extended as it’s come near a historically bearish trendline.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, Walgreens Boots Alliance stock is trading within one standard deviation of its 60-day moving average. The equity has seen six similar signals in the past three years, and was negative one month later 83% of the time averaging a 2.9% dip. A comparable move would place WBA back below $31.

An unwinding of optimism in the options pits could create additional headwinds. This is per WBA’s 50-day call/put volume ratio of 3.62 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits higher than all readings from the last year. This indicates long calls have been getting picked up at a much faster-than-usual rate clip.

It’s worth noting Walgreens Boots Alliance stock’s Schaeffer’s Volatility Scorecard (SVS) stands at 90 out of 100. In other words, the security has generally exceeded options traders’ volatility expectations over the past 12 months.

Image and article originally from www.schaeffersresearch.com. Read the original article here.