Overall options volume is running at triple the intraday average in response

VF Corp (NYSE:VFC) is taking a hit today, down 10.8% to trade at $29.62 at last check. Today’s negative price action follows the sudden retirement of CEO Steve Rendle, and appointment of Director Benno Dorer as interim CEO. The apparel name, which is the parent of The North Face, also lowered its full-year sales and profit forecasts due to weak consumer demand in North America.

Overall options volume is running at triple the intraday average today. So far, 5,196 calls and 4,496 puts have been traded, with the June 30 call standing out as the most popular contract, followed by the February 35 call.

Short-term options traders have been much more bearish than usual. This is per VFC’s Schaeffer’s put/call open interest ratio (SOIR) of 1.63, which ranks in the 94th percentile of annual readings.

Analysts are also pessimistic, with 13 of the 19 in coverage calling the equity a “hold” or worse. What’s more, short sellers are piling on, with short interest up 13.7% over the last two reporting periods. The 20.73 million shares sold short make up 5.4% of VFC stock’s available float.

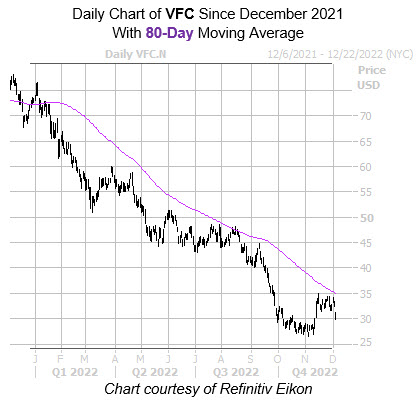

Digging deeper, the security has struggled with a ceiling at the $35 level since early November, while the 80-day moving average has kept a tight lid on the shares for the better part of 2022. Longer term, VFC stock carries a hefty 59.9% year-over-year deficit.

Image and article originally from www.schaeffersresearch.com. Read the original article here.