On April 21, 2023 at 09:44:12 ET an unusually large $5.00K block of Put contracts in Universal Health Services, Inc. – Class B (UHS) was sold, with a strike price of $135.00 / share, expiring in 0 day(s) (on April 21, 2023).

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

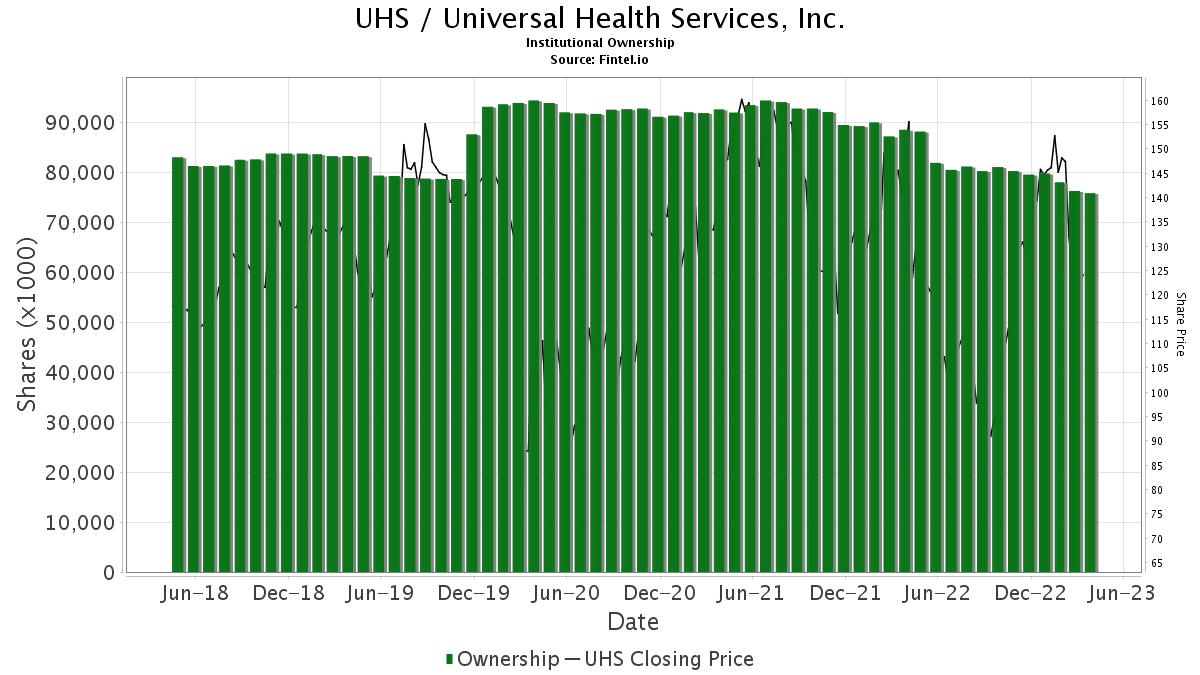

There are 1014 funds or institutions reporting positions in Universal Health Services, Inc. – Class B. This is a decrease of 5 owner(s) or 0.49% in the last quarter. Average portfolio weight of all funds dedicated to UHS is 0.21%, a decrease of 0.27%. Total shares owned by institutions decreased in the last three months by 5.97% to 74,874K shares. The put/call ratio of UHS is 0.43, indicating a bullish outlook.

Analyst Price Forecast Suggests 5.97% Upside

As of April 6, 2023, the average one-year price target for Universal Health Services, Inc. – Class B is $144.20. The forecasts range from a low of $125.24 to a high of $175.35. The average price target represents an increase of 5.97% from its latest reported closing price of $136.08.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Universal Health Services, Inc. – Class B is $14,095MM, an increase of 5.19%. The projected annual non-GAAP EPS is $10.93.

What are Other Shareholders Doing?

SSPIX – SIMT S&P 500 Index Fund Class F holds 2K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 2K shares, representing a decrease of 6.67%. The firm increased its portfolio allocation in UHS by 45.11% over the last quarter.

AVUS – Avantis U.S. Equity ETF holds 11K shares representing 0.02% ownership of the company. In it’s prior filing, the firm reported owning 11K shares, representing an increase of 2.41%. The firm increased its portfolio allocation in UHS by 5.45% over the last quarter.

O’shaughnessy Asset Management holds 48K shares representing 0.07% ownership of the company. In it’s prior filing, the firm reported owning 53K shares, representing a decrease of 11.94%. The firm increased its portfolio allocation in UHS by 23.86% over the last quarter.

JPUS – JPMorgan Diversified Return U.S. Equity ETF holds 11K shares representing 0.02% ownership of the company. In it’s prior filing, the firm reported owning 11K shares, representing a decrease of 1.88%. The firm increased its portfolio allocation in UHS by 22.96% over the last quarter.

SA FUNDS INVESTMENT TRUST – SA U.S. Core Market Fund holds 1K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 2K shares, representing a decrease of 10.52%. The firm increased its portfolio allocation in UHS by 38.65% over the last quarter.

Universal Health Services Background Information

(This description is provided by the company.)

Universal Health Services, Inc. is one of the nation’s largest hospital companies, operating, through its subsidiaries, behavioral health facilities, acute care hospitals, and ambulatory centers throughout the United States, Puerto Rico and the United Kingdom.

See all Universal Health Services, Inc. – Class B regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.