On August 29, 2023 at 12:02:57 ET an unusually large $1,080.00K block of Put contracts in PENN Entertainment (PENN) was bought, with a strike price of $27.50 / share, expiring in 297 day(s) (on June 21, 2024). Fintel tracks all large options trades, and the premium spent on this trade was 9.69 sigmas above the mean, placing it in the 100.00th percentile of all recent large trades made in PENN options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

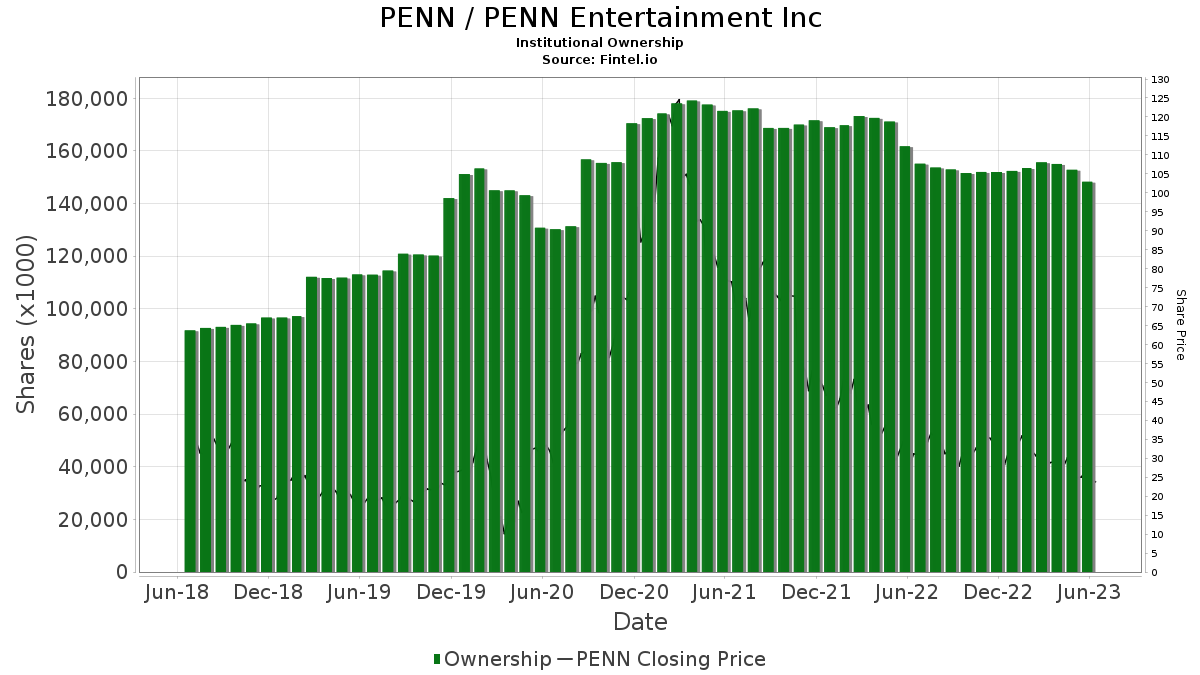

There are 728 funds or institutions reporting positions in PENN Entertainment. This is a decrease of 70 owner(s) or 8.77% in the last quarter. Average portfolio weight of all funds dedicated to PENN is 0.14%, a decrease of 15.46%. Total shares owned by institutions decreased in the last three months by 5.44% to 139,693K shares. The put/call ratio of PENN is 0.43, indicating a bullish outlook.

Analyst Price Forecast Suggests 54.33% Upside

As of August 2, 2023, the average one-year price target for PENN Entertainment is 36.99. The forecasts range from a low of 26.26 to a high of $58.80. The average price target represents an increase of 54.33% from its latest reported closing price of 23.97.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for PENN Entertainment is 6,596MM, an increase of 0.57%. The projected annual non-GAAP EPS is 2.02.

What are Other Shareholders Doing?

HG Vora Capital Management holds 14,500K shares representing 9.60% ownership of the company. In it’s prior filing, the firm reported owning 14,000K shares, representing an increase of 3.45%. The firm decreased its portfolio allocation in PENN by 17.34% over the last quarter.

Bamco holds 7,437K shares representing 4.92% ownership of the company. In it’s prior filing, the firm reported owning 7,659K shares, representing a decrease of 2.98%. The firm decreased its portfolio allocation in PENN by 27.43% over the last quarter.

FBGRX – Fidelity Blue Chip Growth Fund holds 6,599K shares representing 4.37% ownership of the company. In it’s prior filing, the firm reported owning 6,811K shares, representing a decrease of 3.22%. The firm decreased its portfolio allocation in PENN by 21.84% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 4,763K shares representing 3.15% ownership of the company. In it’s prior filing, the firm reported owning 4,720K shares, representing an increase of 0.91%. The firm decreased its portfolio allocation in PENN by 24.57% over the last quarter.

BGRFX – BARON GROWTH FUND holds 4,721K shares representing 3.13% ownership of the company. In it’s prior filing, the firm reported owning 4,820K shares, representing a decrease of 2.09%. The firm decreased its portfolio allocation in PENN by 23.35% over the last quarter.

PENN Entertainment Background Information

(This description is provided by the company.)

With the nation’s largest and most diversified regional gaming footprint, including 41 properties across 19 states, Penn National continues to evolve into a highly innovative omni-channel provider of retail and online gaming, live racing and sports betting entertainment. The Company’s properties feature approximately 50,000 gaming machines, 1,300 table games and 8,800 hotel rooms, and operate under various well-known brands, including Hollywood, Ameristar, and L’Auberge. Its wholly-owned interactive division, Penn Interactive, operates retail sports betting across the Company’s portfolio, as well online social casino, bingo, and iCasino products. In February 2020, Penn National entered into a strategic partnership with Barstool Sports, whereby Barstool is exclusively promoting the Company’s land-based and online casinos and sports betting products, including the Barstool Sportsbook mobile app, to its national audience. The Company’s omni-channel approach is bolstered by the mychoice loyalty program, which rewards and recognizes its over 20 million members for their loyalty to both retail and online gaming and sports betting products with the most dynamic set of offers, experiences, and service levels in the industry.

Additional reading:

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.