On May 26, 2023 at 11:19:22 ET an unusually large $1,091.34K block of Put contracts in Medical Properties Trust (MPW) was sold, with a strike price of $7.00 / share, expiring in 112 day(s) (on September 15, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 6.18 sigmas above the mean, placing it in the 100.00th percentile of all recent large trades made in MPW options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

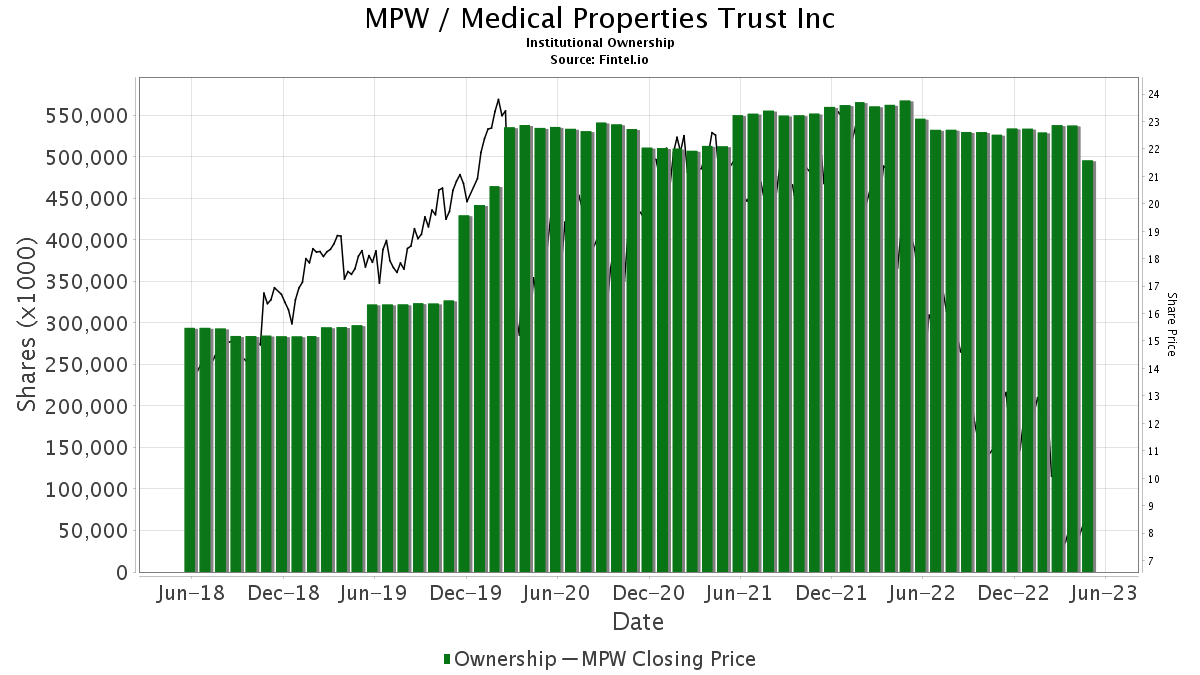

There are 1067 funds or institutions reporting positions in Medical Properties Trust. This is a decrease of 33 owner(s) or 3.00% in the last quarter. Average portfolio weight of all funds dedicated to MPW is 0.20%, a decrease of 3.03%. Total shares owned by institutions decreased in the last three months by 7.58% to 495,409K shares. The put/call ratio of MPW is 2.13, indicating a bearish outlook.

Analyst Price Forecast Suggests 56.11% Upside

As of May 11, 2023, the average one-year price target for Medical Properties Trust is 12.00. The forecasts range from a low of 8.08 to a high of $18.90. The average price target represents an increase of 56.11% from its latest reported closing price of 7.69.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Medical Properties Trust is 1,574MM, an increase of 3.01%. The projected annual non-GAAP EPS is 1.26.

What are Other Shareholders Doing?

VGSIX – Vanguard Real Estate Index Fund Investor Shares holds 26,715K shares representing 4.47% ownership of the company. In it’s prior filing, the firm reported owning 27,209K shares, representing a decrease of 1.85%. The firm increased its portfolio allocation in MPW by 1.71% over the last quarter.

IJH – iShares Core S&P Mid-Cap ETF holds 18,479K shares representing 3.09% ownership of the company. In it’s prior filing, the firm reported owning 18,467K shares, representing an increase of 0.06%. The firm decreased its portfolio allocation in MPW by 29.33% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 18,159K shares representing 3.04% ownership of the company. In it’s prior filing, the firm reported owning 17,848K shares, representing an increase of 1.71%. The firm decreased its portfolio allocation in MPW by 11.75% over the last quarter.

NAESX – Vanguard Small-Cap Index Fund Investor Shares holds 15,406K shares representing 2.57% ownership of the company. In it’s prior filing, the firm reported owning 15,208K shares, representing an increase of 1.29%. The firm decreased its portfolio allocation in MPW by 11.91% over the last quarter.

Bank of New York Mellon holds 12,673K shares representing 2.12% ownership of the company. In it’s prior filing, the firm reported owning 17,997K shares, representing a decrease of 42.01%. The firm decreased its portfolio allocation in MPW by 94.27% over the last quarter.

Medical Properties Trust Declares $0.29 Dividend

On April 27, 2023 the company declared a regular quarterly dividend of $0.29 per share ($1.16 annualized). Shareholders of record as of June 15, 2023 will receive the payment on July 13, 2023. Previously, the company paid $0.29 per share.

At the current share price of $7.69 / share, the stock’s dividend yield is 15.08%.

Looking back five years and taking a sample every week, the average dividend yield has been 6.54%, the lowest has been 4.42%, and the highest has been 15.70%. The standard deviation of yields is 2.20 (n=237).

The current dividend yield is 3.89 standard deviations above the historical average.

Additionally, the company’s dividend payout ratio is 2.29. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend – not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is 0.07%, demonstrating that it has increased its dividend over time.

Medical Properties Trust Background Information

(This description is provided by the company.)

Medical Properties Trust, Inc. is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. From its inception in Birmingham, Alabama, the Company has grown to become one of the world’s largest owners of hospitals with approximately 430 facilities and roughly 43,000 licensed beds in nine countries and across four continents on a pro forma basis. MPT’s financing model facilitates acquisitions and recapitalizations and allows operators of hospitals to unlock the value of their real estate assets to fund facility improvements, technology upgrades and other investments in operations.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.