On May 11, 2023 at 09:37:54 ET an unusually large $810.00K block of Put contracts in iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) was sold, with a strike price of $108.00 / share, expiring in 36 day(s) (on June 16, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 1.72 sigmas above the mean, placing it in the 96.27th percentile of all recent large trades made in LQD options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

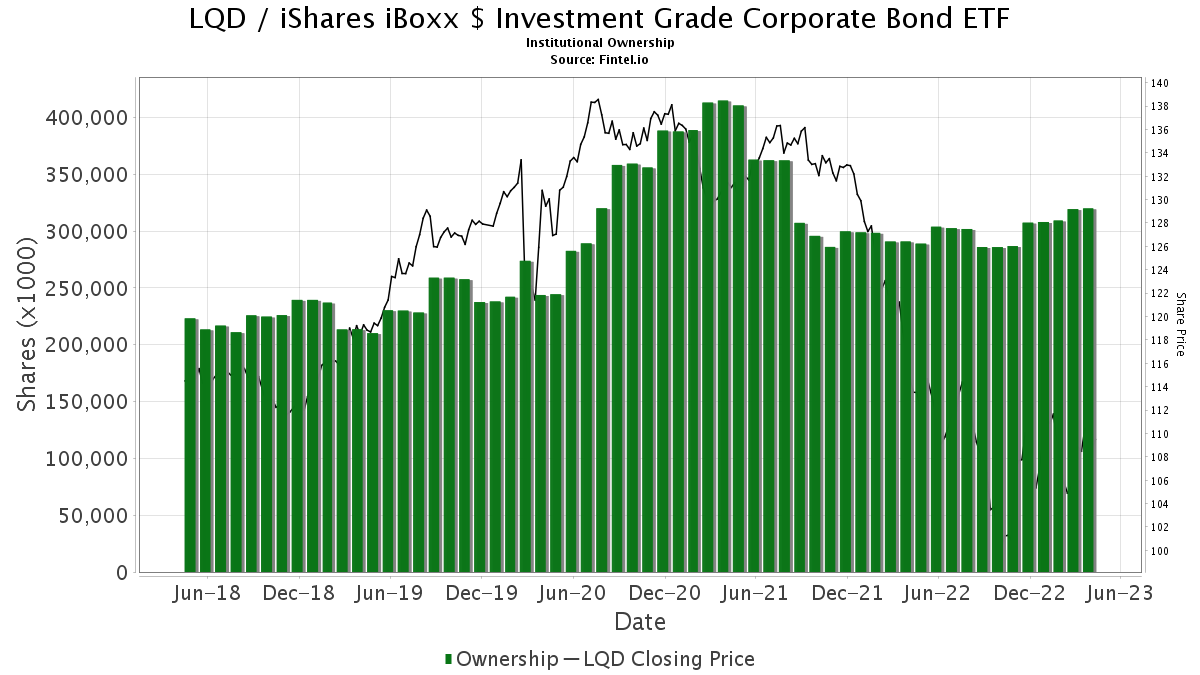

There are 1147 funds or institutions reporting positions in iShares iBoxx $ Investment Grade Corporate Bond ETF. This is an increase of 31 owner(s) or 2.78% in the last quarter. Average portfolio weight of all funds dedicated to LQD is 1.32%, a decrease of 7.40%. Total shares owned by institutions increased in the last three months by 5.30% to 334,041K shares. The put/call ratio of LQD is 3.12, indicating a bearish outlook.

What are Other Shareholders Doing?

Bank Of America holds 30,374K shares. In it’s prior filing, the firm reported owning 32,290K shares, representing a decrease of 6.31%. The firm decreased its portfolio allocation in LQD by 7.75% over the last quarter.

Nuveen Asset Management holds 24,990K shares. No change in the last quarter.

Fisher Asset Management holds 15,144K shares. In it’s prior filing, the firm reported owning 15,524K shares, representing a decrease of 2.51%. The firm decreased its portfolio allocation in LQD by 9.14% over the last quarter.

Japan Science & Technology Agency holds 13,806K shares. No change in the last quarter.

Ameriprise Financial holds 12,447K shares. In it’s prior filing, the firm reported owning 12,816K shares, representing a decrease of 2.97%. The firm decreased its portfolio allocation in LQD by 6.01% over the last quarter.

See all iShares iBoxx $ Investment Grade Corporate Bond ETF regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.