On April 21, 2023 at 09:36:11 ET an unusually large $216.00K block of Call contracts in ProShares UltraPro Russell2000 (URTY) was sold, with a strike price of $35.00 / share, expiring in 28 day(s) (on May 19, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 1.91 sigmas above the mean, placing it in the 99.20th percentile of all recent large trades made in URTY options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

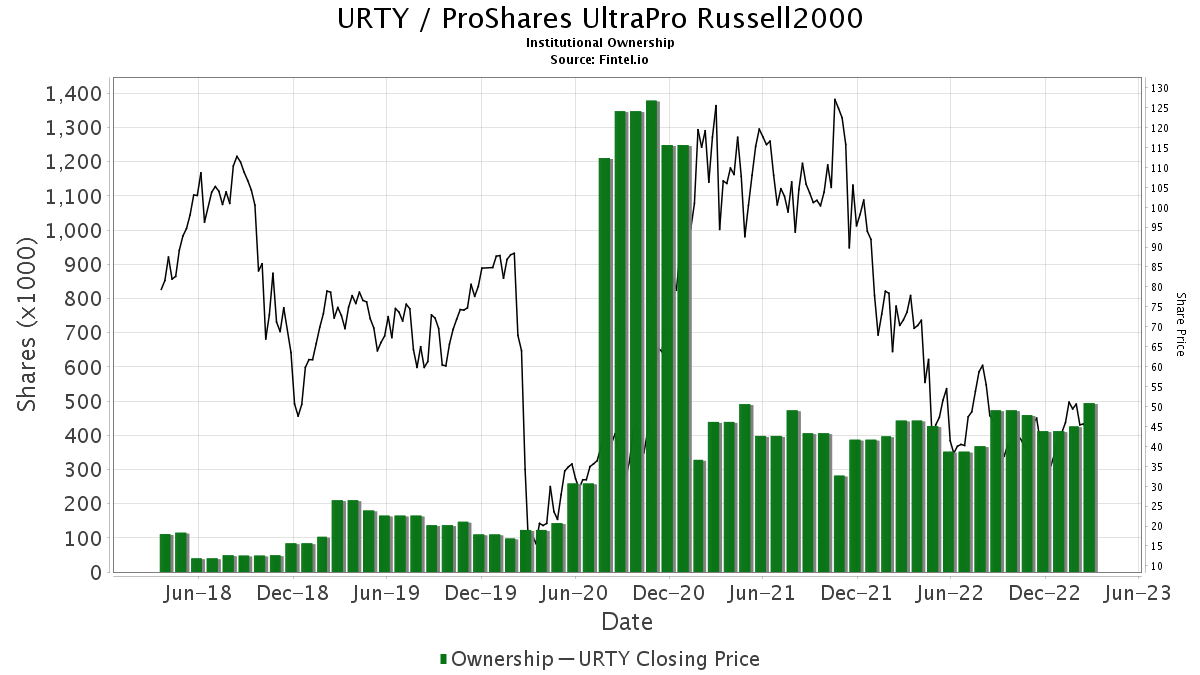

There are 26 funds or institutions reporting positions in ProShares UltraPro Russell2000. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to URTY is 0.45%, an increase of 1.86%. Total shares owned by institutions increased in the last three months by 21.69% to 502K shares. The put/call ratio of URTY is 0.49, indicating a bullish outlook.

What are Other Shareholders Doing?

Prime Capital Investment Advisors holds 54K shares. In it’s prior filing, the firm reported owning 56K shares, representing a decrease of 4.53%. The firm decreased its portfolio allocation in URTY by 30.73% over the last quarter.

Kwmg holds 18K shares. No change in the last quarter.

UBS Group holds 1K shares. In it’s prior filing, the firm reported owning 8K shares, representing a decrease of 582.27%. The firm decreased its portfolio allocation in URTY by 86.33% over the last quarter.

Cutler Group holds 1K shares. In it’s prior filing, the firm reported owning 0K shares, representing an increase of 100.00%.

Citadel Advisors holds 77K shares. In it’s prior filing, the firm reported owning 9K shares, representing an increase of 88.25%. The firm increased its portfolio allocation in URTY by 856.11% over the last quarter.

See all ProShares UltraPro Russell2000 regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.