On July 7, 2023 at 15:52:43 ET an unusually large $257.13K block of Call contracts in Eos Energy Enterprises Inc – (EOSE) was bought, with a strike price of $2.50 / share, expiring in 196 day(s) (on January 19, 2024). Fintel tracks all large options trades, and the premium spent on this trade was 3.12 sigmas above the mean, placing it in the 99.92th percentile of all recent large trades made in EOSE options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

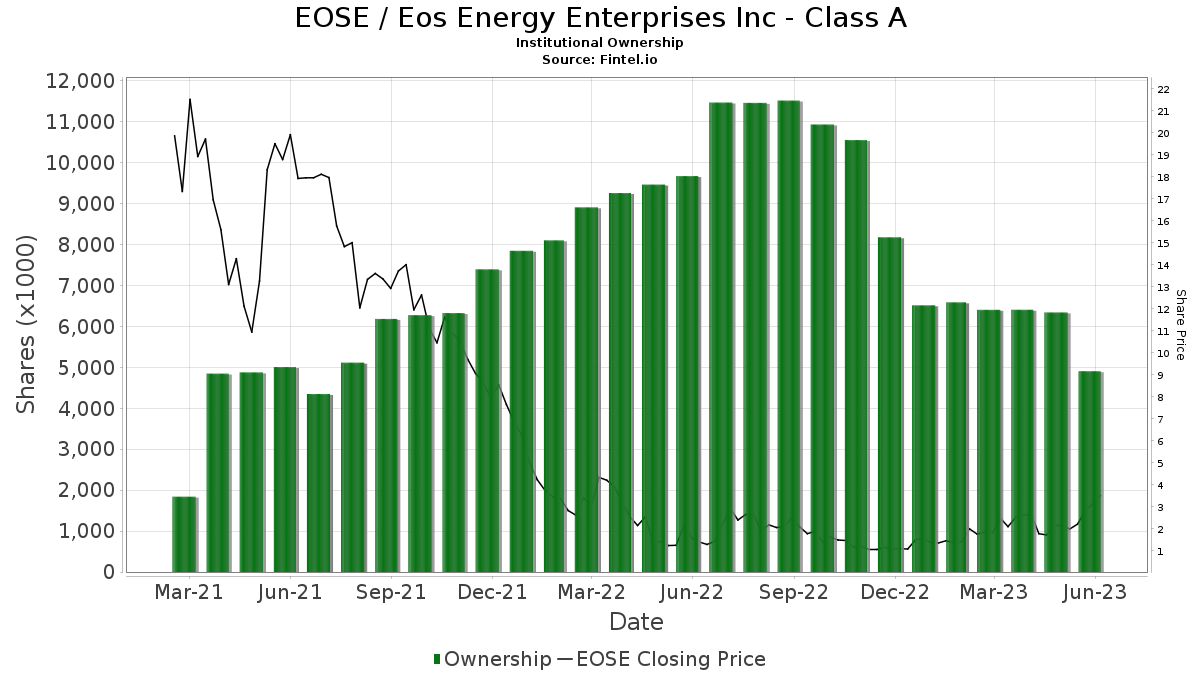

There are 28 funds or institutions reporting positions in Eos Energy Enterprises Inc -. This is a decrease of 1 owner(s) or 3.45% in the last quarter. Average portfolio weight of all funds dedicated to EOSE is 0.02%, a decrease of 32.64%. Total shares owned by institutions decreased in the last three months by 23.43% to 4,905K shares. The put/call ratio of EOSE is 0.14, indicating a bullish outlook.

Analyst Price Forecast Suggests 34.27% Upside

As of July 6, 2023, the average one-year price target for Eos Energy Enterprises Inc – is 5.40. The forecasts range from a low of 2.78 to a high of $13.65. The average price target represents an increase of 34.27% from its latest reported closing price of 4.02.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Eos Energy Enterprises Inc – is 141MM, an increase of 499.29%. The projected annual non-GAAP EPS is -1.89.

What are Other Shareholders Doing?

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 2,141K shares representing 1.79% ownership of the company. In it’s prior filing, the firm reported owning 1,694K shares, representing an increase of 20.88%. The firm increased its portfolio allocation in EOSE by 102.67% over the last quarter.

VEXMX – Vanguard Extended Market Index Fund Investor Shares holds 1,120K shares representing 0.94% ownership of the company. In it’s prior filing, the firm reported owning 792K shares, representing an increase of 29.31%. The firm increased its portfolio allocation in EOSE by 132.12% over the last quarter.

QCLN – First Trust Nasdaq Clean Edge Green Energy Index Fund holds 503K shares representing 0.42% ownership of the company. In it’s prior filing, the firm reported owning 384K shares, representing an increase of 23.77%. The firm increased its portfolio allocation in EOSE by 215.67% over the last quarter.

FSMAX – Fidelity Extended Market Index Fund holds 364K shares representing 0.30% ownership of the company. In it’s prior filing, the firm reported owning 278K shares, representing an increase of 23.65%. The firm increased its portfolio allocation in EOSE by 160.21% over the last quarter.

ETHO – Etho Climate Leadership U.S. ETF holds 173K shares representing 0.14% ownership of the company. In it’s prior filing, the firm reported owning 168K shares, representing an increase of 2.98%. The firm increased its portfolio allocation in EOSE by 64.26% over the last quarter.

Eos Energy Enterprises Background Information

(This description is provided by the company.)

Eos Energy Enterprises, Inc. is accelerating the shift to clean energy with positively ingenious solutions that transform how the world stores power. Its breakthrough Znyth® aqueous zinc battery was designed to overcome the limitations of conventional lithium-ion technology. Safe, scalable, efficient, sustainable – and manufactured in the U.S. – it’s the core of its innovative systems that today provide utility, industrial, and commercial customers with a proven, reliable energy storage alternative. Eos was founded in 2008 and is headquartered in Edison, New Jersey.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.