On August 4, 2023 at 13:58:00 ET an unusually large $258.71K block of Call contracts in Coherent (COHR) was bought, with a strike price of $55.00 / share, expiring in 42 day(s) (on September 15, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 1.63 sigmas above the mean, placing it in the 99.81th percentile of all recent large trades made in COHR options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

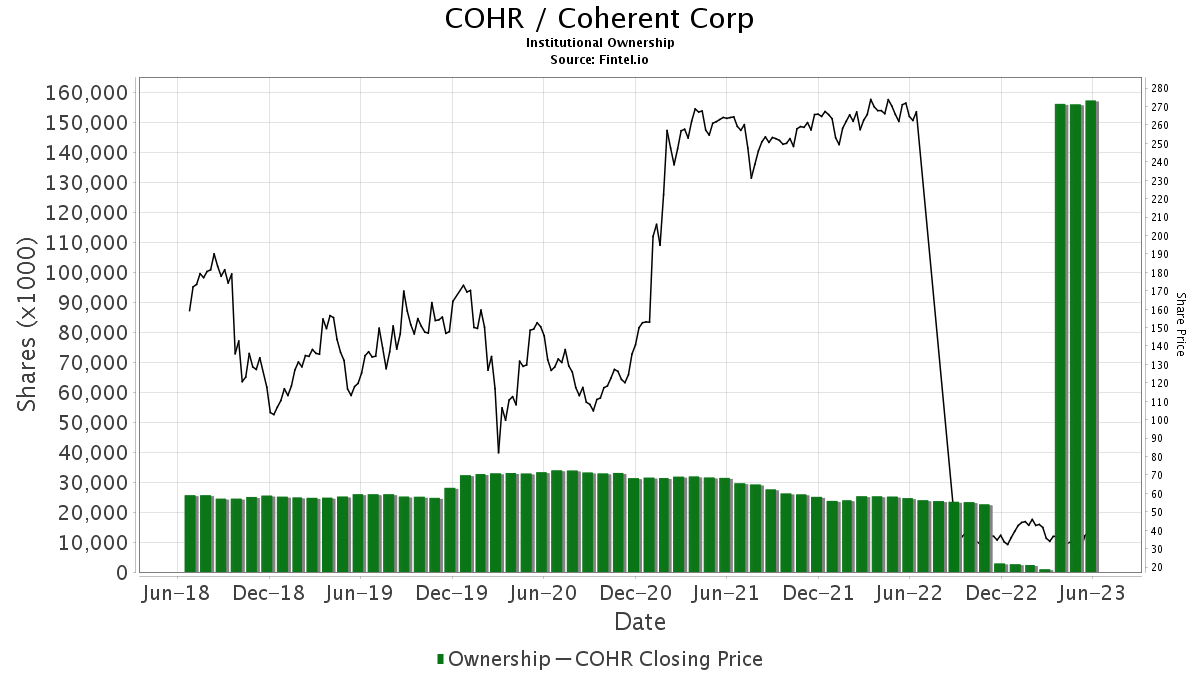

There are 871 funds or institutions reporting positions in Coherent. This is a decrease of 1 owner(s) or 0.11% in the last quarter. Average portfolio weight of all funds dedicated to COHR is 0.27%, an increase of 17.23%. Total shares owned by institutions increased in the last three months by 1.91% to 158,821K shares. The put/call ratio of COHR is 0.36, indicating a bullish outlook.

Analyst Price Forecast Suggests 10.36% Upside

As of August 2, 2023, the average one-year price target for Coherent is 51.89. The forecasts range from a low of 40.40 to a high of $89.25. The average price target represents an increase of 10.36% from its latest reported closing price of 47.02.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Coherent is 5,952MM, an increase of 22.92%. The projected annual non-GAAP EPS is 4.74.

What are Other Shareholders Doing?

Dodge & Cox holds 19,343K shares representing 12.93% ownership of the company. In it’s prior filing, the firm reported owning 19,056K shares, representing an increase of 1.48%. The firm increased its portfolio allocation in COHR by 9.42% over the last quarter.

DODGX – Dodge & Cox Stock Fund holds 11,297K shares representing 7.55% ownership of the company. No change in the last quarter.

Macquarie Group holds 5,042K shares representing 3.37% ownership of the company. In it’s prior filing, the firm reported owning 4,575K shares, representing an increase of 9.26%. The firm increased its portfolio allocation in COHR by 20.27% over the last quarter.

American Century Companies holds 4,625K shares representing 3.09% ownership of the company. In it’s prior filing, the firm reported owning 4,630K shares, representing a decrease of 0.11%. The firm increased its portfolio allocation in COHR by 4.51% over the last quarter.

IJH – iShares Core S&P Mid-Cap ETF holds 4,287K shares representing 2.87% ownership of the company. In it’s prior filing, the firm reported owning 4,283K shares, representing an increase of 0.10%. The firm increased its portfolio allocation in COHR by 3.94% over the last quarter.

Coherent Background Information

(This description is provided by the company.)

II-VI Incorporated, a global leader in engineered materials and optoelectronic components, is a vertically integrated manufacturing company that develops innovative products for diversified applications in communications, materials processing, aerospace & defense, semiconductor capital equipment, life sciences, consumer electronics, and automotive markets. Headquartered in Saxonburg, Pennsylvania, U.S.A., the Company has research and development, manufacturing, sales, service, and distribution facilities worldwide. The Company produces a wide variety of application-specific photonic and electronic materials and components, and deploys them in various forms, including integrated with advanced software to support its customers.

Additional reading:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.