On April 14, 2023 at 10:13:09 ET an unusually large

$237.62K block of Call contracts in Ciena

(CIEN) was sold,

with a strike price of $50.00 / share, expiring in 7 day(s) (on April 21, 2023).

Fintel tracks all large options trades, and the premium spent on this trade was 4.02 sigmas above the mean, placing it in the 100.00th percentile of all recent large trades made in CIEN options.

This trade was first picked up on Fintel’s real time Unusual Option Trades

tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

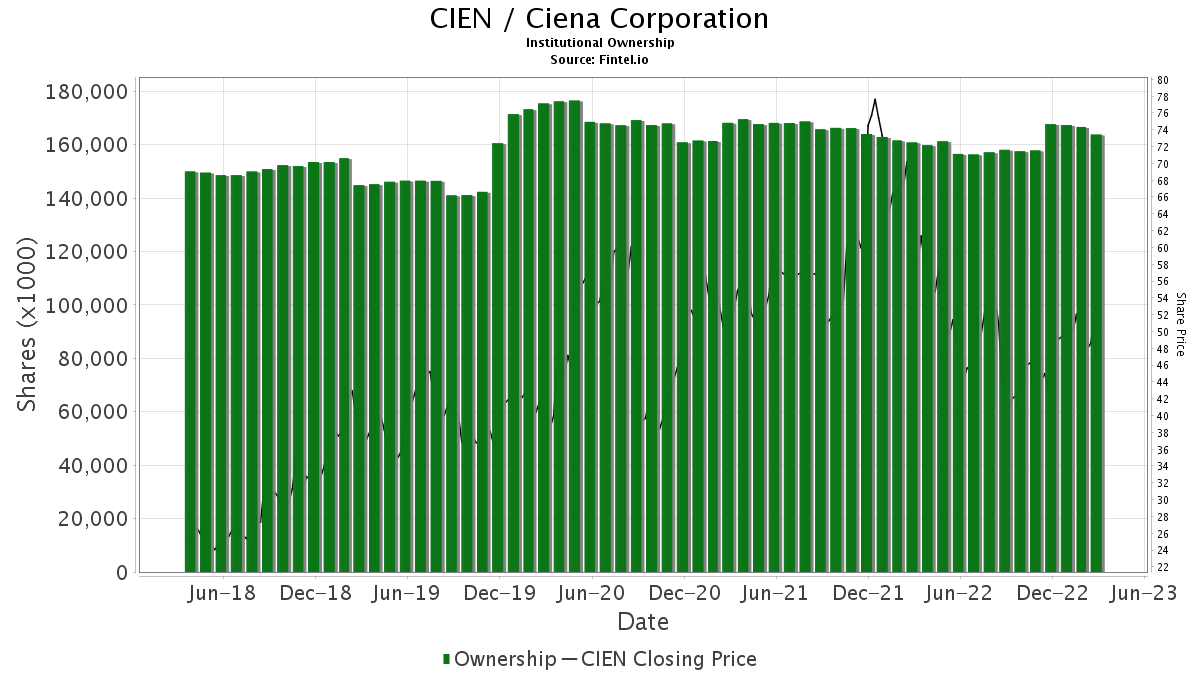

There are 961 funds or institutions reporting positions in Ciena.

This is an increase

of

10

owner(s) or 1.05% in the last quarter.

Average portfolio weight of all funds dedicated to CIEN is 0.32%,

an increase

of 6.64%.

Total shares owned by institutions decreased

in the last three months by 1.96% to 163,509K shares.

The put/call ratio of CIEN is 0.42, indicating a

bullish

outlook.

Analyst Price Forecast Suggests 26.99% Upside

As of April 6, 2023,

the average one-year price target for Ciena is $65.78.

The forecasts range from a low of $45.45 to a high of $90.30.

The average price target represents an increase of 26.99% from its latest reported closing price of $51.80.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Ciena

is $4,290MM, an increase of 11.58%.

The projected annual non-GAAP EPS

is $2.68.

What are Other Shareholders Doing?

Private Trust Co Na

holds 1K shares

representing 0.00% ownership of the company.

In it’s prior filing, the firm reported owning 1K shares, representing

an increase

of 13.80%.

The firm

increased

its portfolio allocation in CIEN by 109,636.38% over the last quarter.

JNL SERIES TRUST – JNL

holds 16K shares

representing 0.01% ownership of the company.

In it’s prior filing, the firm reported owning 21K shares, representing

a decrease

of 33.68%.

The firm

decreased

its portfolio allocation in CIEN by 9.16% over the last quarter.

CenterBook Partners

holds 34K shares

representing 0.02% ownership of the company.

In it’s prior filing, the firm reported owning 67K shares, representing

a decrease

of 96.56%.

The firm

decreased

its portfolio allocation in CIEN by 99.94% over the last quarter.

RMYAX – Multi-Strategy Income Fund

holds 3K shares

representing 0.00% ownership of the company.

In it’s prior filing, the firm reported owning 2K shares, representing

an increase

of 53.18%.

The firm

increased

its portfolio allocation in CIEN by 124.19% over the last quarter.

SCUVX – Hartford Schroders US Small Cap Opportunities Fund

holds 60K shares

representing 0.04% ownership of the company.

In it’s prior filing, the firm reported owning 52K shares, representing

an increase

of 12.77%.

The firm

increased

its portfolio allocation in CIEN by 21.10% over the last quarter.

CIENA Background Information

(This description is provided by the company.)

Ciena is a networking systems, services and software company. The Company provides solutions that help its customers create the Adaptive Network™ in response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, the Company builds the world’s most agile networks with automation, openness and scale.

See all Ciena regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.