On May 19, 2023 at 11:37:08 ET an unusually large $27.50K block of Call contracts in Adaptive Biotechnologies (ADPT) was bought, with a strike price of $7.50 / share, expiring in 28 day(s) (on June 16, 2023). Fintel tracks all large options trades, and the premium spent on this trade was 1.65 sigmas above the mean, placing it in the 100.00th percentile of all recent large trades made in ADPT options.

This trade was first picked up on Fintel’s real time Options Flow tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

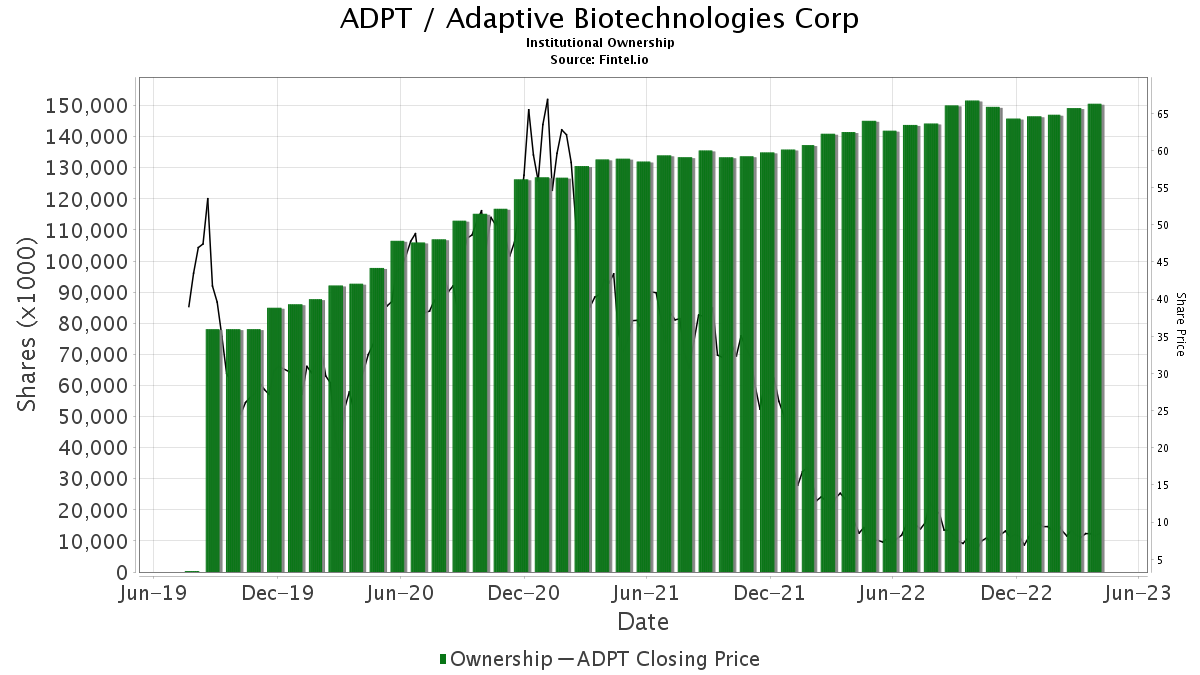

There are 465 funds or institutions reporting positions in Adaptive Biotechnologies. This is a decrease of 9 owner(s) or 1.90% in the last quarter. Average portfolio weight of all funds dedicated to ADPT is 0.13%, an increase of 19.98%. Total shares owned by institutions increased in the last three months by 0.84% to 150,009K shares. The put/call ratio of ADPT is 0.35, indicating a bullish outlook.

Analyst Price Forecast Suggests 102.45% Upside

As of May 11, 2023, the average one-year price target for Adaptive Biotechnologies is 12.53. The forecasts range from a low of 7.07 to a high of $15.75. The average price target represents an increase of 102.45% from its latest reported closing price of 6.19.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Adaptive Biotechnologies is 223MM, an increase of 20.82%. The projected annual non-GAAP EPS is -1.36.

What are Other Shareholders Doing?

Viking Global Investors holds 29,994K shares representing 20.78% ownership of the company. No change in the last quarter.

Matrix Capital Management Company holds 11,573K shares representing 8.02% ownership of the company. No change in the last quarter.

ARKG – ARK Genomic Revolution ETF holds 9,253K shares representing 6.41% ownership of the company. In it’s prior filing, the firm reported owning 9,088K shares, representing an increase of 1.79%. The firm increased its portfolio allocation in ADPT by 27.27% over the last quarter.

ARK Investment Management holds 9,205K shares representing 6.38% ownership of the company. In it’s prior filing, the firm reported owning 9,201K shares, representing an increase of 0.04%. The firm decreased its portfolio allocation in ADPT by 8.30% over the last quarter.

Nikko Asset Management Americas holds 5,323K shares representing 3.69% ownership of the company. In it’s prior filing, the firm reported owning 5,352K shares, representing a decrease of 0.56%. The firm decreased its portfolio allocation in ADPT by 12.30% over the last quarter.

Adaptive Biotechnologies Background Information

(This description is provided by the company.)

Adaptive Biotechnologies is a commercial-stage biotechnology company focused on harnessing the inherent biology of the adaptive immune system to transform the diagnosis and treatment of disease. Adaptive Biotechnologies believes the adaptive immune system is nature’s most finely tuned diagnostic and therapeutic for most diseases, but the inability to decode it has prevented the medical community from fully leveraging its capabilities. Its proprietary immune medicine platform reveals and translates the massive genetics of the adaptive immune system with scale, precision and speed to develop products in life sciences research, clinical diagnostics, and drug discovery. We have three commercial products, and a robust clinical pipeline to diagnose, monitor and enable the treatment of diseases such as cancer, autoimmune conditions and infectious diseases. Our goal is to develop and commercialize immune-driven clinical products tailored to each individual patient.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.