Unity Software stock has reclaimed a long-term trendline

Every day for the next three weeks, we’re going to highlight one of Schaeffer’s top 12 picks for 2024. Next up, we have video game technology developer Unity Software Inc (NYSE:U). To access the entirety of the 2024 report, click here.

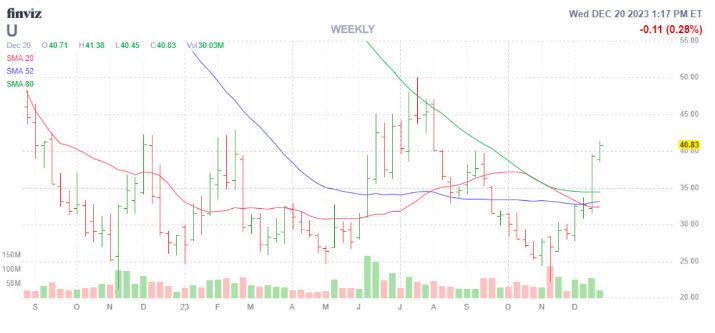

Video game developer Unity Software (U) has seen its fundamentals stabilize thanks to a conservative 2024 guidance that sets up for potential upwardly revised raises in future earnings reports. The stock has crossed above its 80-week moving average, which capped gains back in September. Now back above its 20-and 52-week moving averages as well, these trendlines are curling to support recent price action. There are possible price retracement targets sitting significantly above that present a compelling risk/reward setup. U’s initial public offering (IPO) price is $52, the $85-$95 zone is a massive support/resistance level, and a 50% Fibonacci retracement from highs to lows would sit at $115.

An unwinding of pessimism could trigger tailwinds. The stock’s 12-month consensus price target is a 17% premium to its current perch, which could force analysts to revise their targets next year. Short interest is a healthy 9.5% of U’s total available float, with the majority of these bearish bets added when the stock was below $40. A breakout from this base could trigger a massive, short-covering rally in 2024.

In the options pits, there are large put levels at the 25-and 30-strikes to trade against all year. The good news for premium buyers: the stock’s Schaeffer’s Volatility Index (SVI) of 53% sits in just the 11th annual percentile, revealing low volatility expectations are being priced into near-term contracts. Plus, the stock has consistently rewarded premium buyers over the past year, per its Schaeffer’ s Volatility Scorecard (SVS) reading of 72 out of a possible 100. This shows the equity has tended to make larger-than- expected moves on the chart, compared to what the options market has priced in.

Image and article originally from www.schaeffersresearch.com. Read the original article here.