DASH’s leading market share and technical foundation is appealing to long-term investors

Every day for the next three weeks, we’re going to highlight one of Schaeffer’s top 12 picks for 2024. First up, we have food delivery stock DoorDash Inc (NYSE:DASH). To access the entirety of the 2023 report, click here.

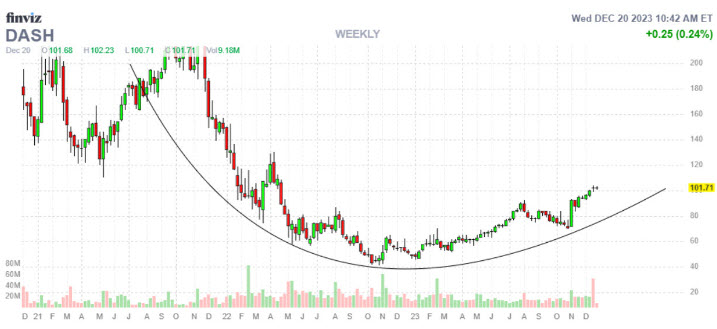

DoorDash (DASH) is up more than 70% year-over-year, with each successive move higher accompanied by a series of both higher highs and lower lows. This implies continued strength for an equity trading well below it’s longer-term highs. Now trading near its initial public offering (IPO) price of $102, there are signs of a breakout above this significant level.

This is an enticing opportunity for investors to target a growing company with a leading market share at a 45% discount, relative to its debut price of $182. There are two paths to out sized returns. First, DASH’s 2023 peak is coming above the critical 23.6% Fibonacci level, with technicals suggesting medium-term upside of approximately 30%, if March’s peak fails to cap further upside. A retest of April 2021 highs could mean a move to $165, which is a more than 67% premium to the stock’s current price.

Second, after consolidating into and above July 2023 highs at $91, a retest of April 2022 highs would value DASH at nearly $130, which is a 27% above it’s current stance. This area also coincides with the brokerage community’s high-end forecast over the next 12 months.

Image and article originally from www.schaeffersresearch.com. Read the original article here.