Estee Lauder stock has bullish seasonality on its side

Subscribers to Chart of the Week received this commentary on Sunday, November 27.

High-end retailer Estee Lauder Companies Inc (NYSE:EL) has been getting some buzz ahead of the gift-giving season after the company confirmed recent rumors that it would buy luxury brand Tom Ford in a deal valued at $2.8 billion. The deal is expected to close during the first half of 2023, and will completely absorb Tom Ford Brands, which has already partnered with Estee Lauder, into the cosmetics giant’s massive portfolio.

It’s a busy time for Estee Lauder, which owns Clinique, La Mer, Aveda, Le Labo, and Bumble and Bumble, just to name a few. The acquisition news, which started bubbling up in early November, seems to be a good thing for the stock, which has added over 11% this month and could snap a three-month losing streak. It’s been a notable recovery considering that early on in the month, the beauty company cut its full-year forecast, citing, among other things, China’s strict Covid-19 protocols.

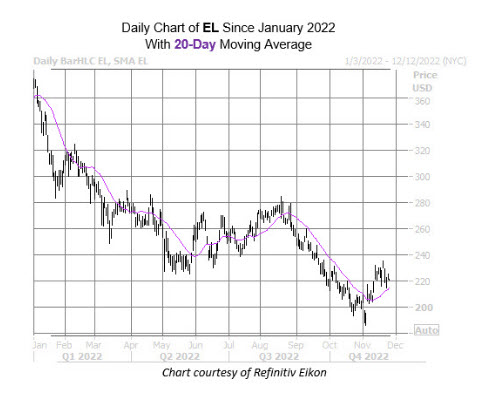

While the news initially sent the security to a two-year low of $186.47 on Nov. 3, the very next day EL gapped higher by 8.6%, fully paring the Nov. 2 8.1% post-earnings bear gap. It might also be worth noting that a Barron’s article written by Jacob Sonenshine came out on Wednesday, making a case for China reopening its economy and boosting stocks that rely on the region for a significant portion of sales. “There’s still ambiguity about how quickly China will indeed reopen,” Sonenshine says, “If the news gets better, those stocks could go higher.”

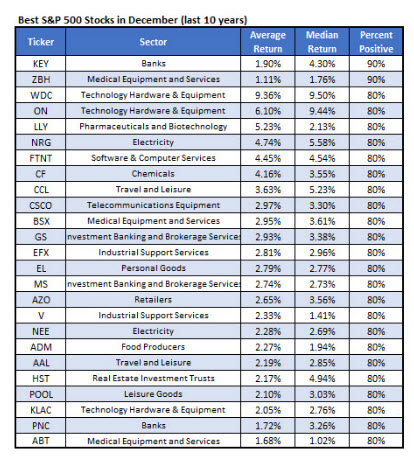

EL investors should absolutely keep an eye on China, but for those looking at seasonal indicators, EL is waving a green flag. The stock just popped up on Schaeffer’s Senior Quantitative analyst Rocky White’s list of 25 stocks with the highest returns in December. According to White’s data, EL has realized higher returns during this time period 80% of the time, averaging a return of 2.8%. A similar return from its current perch would put the equity back near the $230 region, which marks its fourth-quarter highs.

Estee Lauder stock did pull back from the $230 area earlier this week. However, a confluence of trendlines, including the 20-day moving average, stepped in as support. This is interesting as many of these moving averages acted as pressure during EL’s aforementioned three-month losing streak. Year-to-date, the stock is still down nearly 40%, though it’s managed to rise to a slim quarter-to-date lead.

Image and article originally from www.schaeffersresearch.com. Read the original article here.