Walgreens Boots Alliance will report earnings before the open on Jan. 5

Walgreens Boots Alliance Inc (NASDAQ:WBA) is gearing up for its fourth-quarter earnings report, due out in two weeks, before the open on Jan. 5. The stock has a split post-earnings history over the last two years, with four of the last eight next-day sessions finishing positive, and four negative. The options pits are pricing in a post-earnings swing of 4.5%, regardless of direction, which is lower than the 5.6% move the stock has averaged over the aforementioned reports.

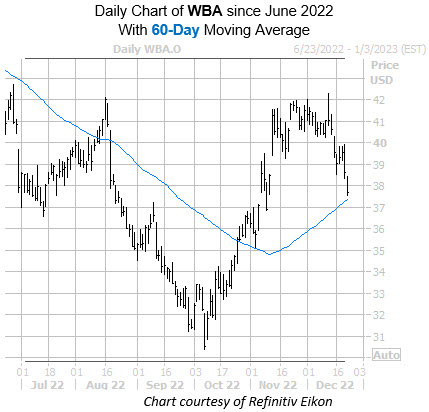

At last glance today, WBA is down 2.5% at $37.65, though the 60-day moving average lingers below as potential support. The $42 level has provided a firm line of pressure since June, and rejected the blue-chip stock’s most recent rally following its Oct. 7 10-year low. It’s worth noting that WBA’s 14-day relative strength index (RSI) of 23.1 sits in “oversold” territory, suggesting a short-term bounce could be in the cards. Year-over-year, the equity is down 25.3%.

The majority of analysts are bearish on Walgreens Boots Alliance. Of the 15 in coverage, 12 carry a “hold” or worse rating, with just three a “strong buy.” The brokerage bunch isn’t betting on WBA breaking out above pressure at the $42 level any time soon either, as the 12-month consensus price target is $42.62.

Image and article originally from www.schaeffersresearch.com. Read the original article here.