Piper Sandler initiated coverage of SHAK with an “overweight” rating

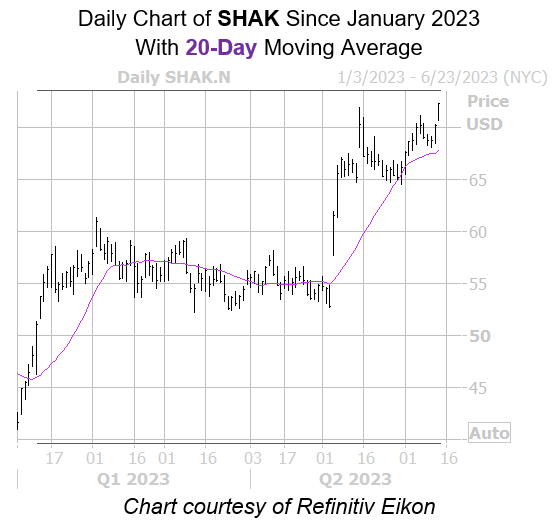

Piper Sandler initiated coverage of Shake Shack Inc (NYSE:SHAK) stock with an “overweight” rating and $84 price target today, while BTIG raised its price objective to $85 from $75. The security was last seen up 3% at $72.27, and earlier scored a fresh one-year high of $72.20, with support from its 20-day moving average. In addition, a historically bullish trendline could help SHAK add to its 72.2% year-to-date lead.

According to Schaeffer’s Quantitative Analyst Rocky White, Shake Shack stock’s recent rally comes amid historically low implied volatility (IV), which has been a bullish combination for shares in the past. White’s data shows three other signals over the last five years when SHAK was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) sat in the 20th percentile of its annual range or lower.

This is currently the case with the security’s SVI of 33%, which sits at the bottom of its annual range. One month after these signals, the shares were higher, averaging an 18% pop. From its current perch, a move of similar magnitude would put SHAK back over the $85 mark for the first time since November 2021.

There’s still plenty of room for upgrades and/or price-target hikes. Of the 14 analysts in coverage, six rate the security a “hold” or worse. Additional tailwinds could stem from a further unwinding of pessimism, with short interest still making up 6.9% of SHAK’s available float.

Image and article originally from www.schaeffersresearch.com. Read the original article here.