A bullish signal could help ROKU close today’s bear gap

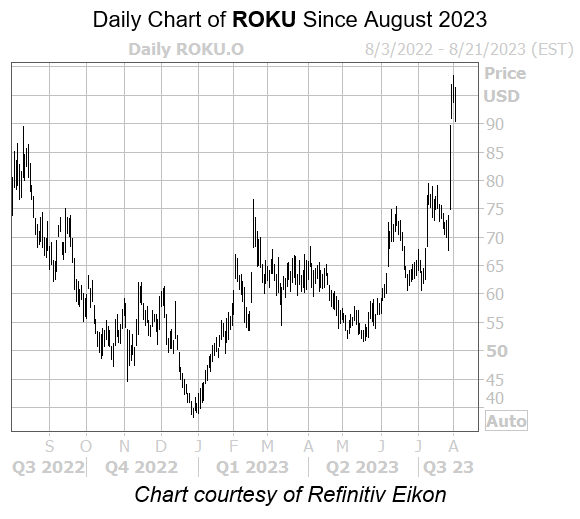

The last time we covered Roku Inc (NASDAQ:ROKU) stock, it was drawing attention from options bulls after a new partnership with Shopify (SHOP). The equity is back in the spotlight today, last seen down 6.3% at $91.37, as it cools off from yesterday’s one-year high of $98.44. It looks like this pullback may be short-lived, however, thanks to a historically bullish signal that could have ROKU adding to its 124.9% year-to-date lead.

Roku stock’s fresh highs come amid historically low implied volatility (IV), according to Schaeffer’s Quantitative Analyst Rocky White, which has been a bullish combination in the past. White’s data shows six other signals over the last five years when ROKU was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) was in the 20th percentile of its annual range or lower.

This is now the case with the stock’s SVI of 61%, which ranks in the low 15th percentile of its annual range. One month after these signals, the shares were higher 67% of the time to average a 6.7% gain. From its current perch, a similar move would push the security towards closing this bear gap.

The brokerage bunch is split on ROKU, with 13 calling it a tepid “hold” or worse, while 12 say “buy” or better. This means a shift in analyst sentiment could generate tailwinds. Plus, the 12.41 million shares sold short now account for 10.1% of the stock’s available float, making it a potential short squeeze candidate.

Image and article originally from www.schaeffersresearch.com. Read the original article here.