The Zacks Basic Materials sector has held up relatively well in 2022, down roughly 18% and outperforming the S&P 500 by a fair margin.

A company in the realm, Steel Dynamics STLD, is on deck to unveil quarterly results on October 19th after market close.

Steel Dynamics is among the leading steel producers and metal recyclers in the United States, with a steelmaking and coating capacity of more than 11 million tons.

Currently, the steel titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How does everything shape up for the company heading into its quarterly print? Let’s take a closer look.

Share Performance & Valuation

STLD shares have been scorching hot in 2022, up nearly 30% and crushing their Zacks sector performance.

Image Source: Zacks Investment Research

Over the last three months, Steel Dynamics shares have continued their strength, up a double-digit 16% and outperforming their Zacks sector by a notable margin in this timeframe as well.

Image Source: Zacks Investment Research

The positive price action of STLD shares indicates that buyers have defended the stock all year long, undoubtedly a positive in a historically-volatile 2022.

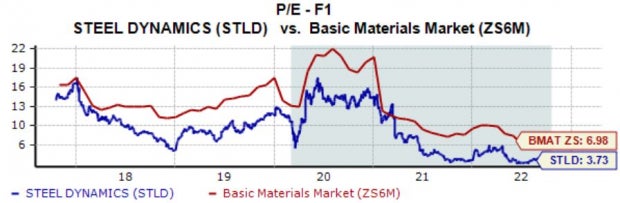

STLD shares currently trade at a 3.7X forward earnings multiple, a fraction of the 8.7X five-year median and reflecting a sizable 47% discount relative to its Zacks sector.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have had mixed reactions to the quarter to be reported over the last several months, with a single positive and negative earnings estimate revision hitting the tape. Still, the Zacks Consensus EPS Estimate of $4.97 suggests a slight 0.2% Y/Y uptick in earnings.

Image Source: Zacks Investment Research

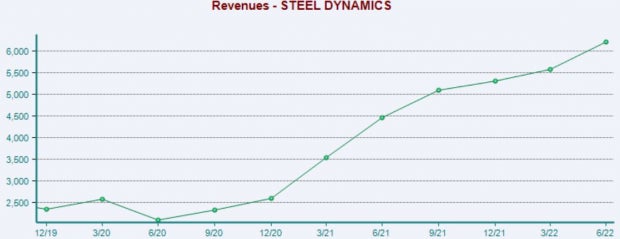

Revenue estimates paint a similar positive story – the Zacks Consensus Sales Estimate of $5.5 billion reflects a 7.7% Y/Y uptick.

Quarterly Performance & Market Reactions

Steel Dynamics has been on an impressive earnings streak, exceeding both the Zacks Consensus EPS and Sales Estimates in each of its last 11 quarters. Just in its latest print, STLD registered a solid 6.2% bottom-line beat paired with a 2.4% revenue beat.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Day traders who prefer the long side should be aware that shares have moved upward following each of the company’s last four prints.

Putting Everything Together

STLD shares have been hot in 2022, outperforming its Zacks sector across multiple timeframes and indicating that buyers have been in control.

Shares trade at solid valuation levels, with the company’s forward P/E ratio sitting nicely below its five-year median. Still, investors should be aware that Basic Materials stocks are cyclical.

Analysts have had mixed reactions to the quarter to be reported, but estimates allude to Y/Y upticks in both revenue and earnings.

Further, the company has consistently exceeded estimates, and the market has had favorable reactions as of late following its quarterly prints.

Heading into the report, Steel Dynamics STLD currently carries a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.