The social media giant is brushing off better-than-expected second-quarter results

Snap Inc (NYSE:SNAP) is plummeting today, despite reporting better-than-expected second-quarter results, after it also announced a lackluster current-quarter forecast. No fewer than seven analysts slashed their price targets, with Goldman Sachs cutting to $7 from $8. At last glance, SNAP was down 16.6% at $10.44.

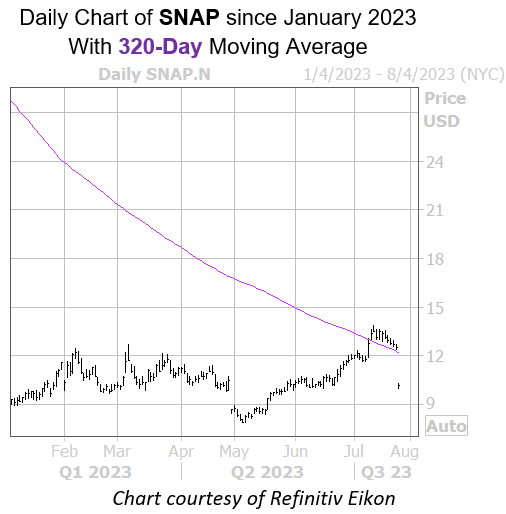

This bear gap has Snap stock slipping below recent support from its descending 320-day moving average, though a familiar floor at the $10 level could keep those losses in check. Year-to-date, the equity is still up 15.7%.

Unsurprisingly, traders are blasting SNAP today, with 295,000 calls and 230,000 puts exchanged so far — four times the average intraday volume. The weekly 7/28 10-strike put is the most popular, with new positions being opened there.

The stock looks like a potential premium-selling candidate at the moment, too, per its Schaeffer’s Volatility Scorecard (SVS), with a score of just 9 out of 100. In other words, the security has consistently realized lower volatility than its options have priced in.

Image and article originally from www.schaeffersresearch.com. Read the original article here.