AT&T announced disappointing first-quarter revenue and subscriber growth

The shares of AT&T Inc (NYSE:T) hit a new annual low of $17.80 earlier today, and were last seen down 8.7% to trade at $17.98 after the company’s first-quarter revenue came in below expectations. Earnings managed to eke above forecasts, but the telecommunications giant added 424,000 subscribers for the quarter, in-line with estimates.

Unsurprisingly, options traders are targeting the security at eight times the intraday average volume. So far, 112,000 calls and 94,000 puts have been exchanged. The April 18.50 call is the most popular, followed by the 18 put in the same monthly series, with new positions being sold-to-open at the former.

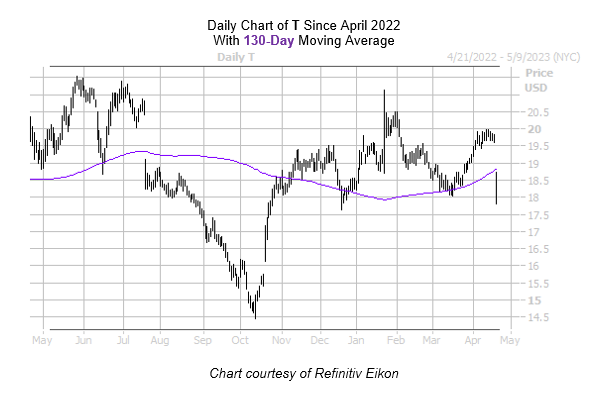

On the charts, this dip has T trading back below its 130-day moving average, and set to close below the trendline for just the second time this year. It’s worth noting that this same trendline moved in as pressure on the charts following the company’s July 2022 report, which coincides with a bear gap that saw the shares eventually hit an Oct. 13, roughly 20-year low of $14.46. The equity is now down 10.3% year-over-year.

A broader looks shows calls have been unusually popular, per AT&T stock’s 50-day call/put volume ratio of 2.23 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 99% of readings from the past year, indicating calls being picked up at a much faster-than-usual rate.

Now may be a good time to weigh in on T’s next move with options, especially so amid a post-earnings volatility crush. The stock’s Schaeffer’s Volatility Index (SVI) of 24% stood higher than just 20% of all other readings in its annual range, implying that options players are pricing in relatively low volatility expectations at the moment.

Image and article originally from www.schaeffersresearch.com. Read the original article here.