Stocks that tend to outperform early in the year usually extend their gains

What to Do with This Year’s Highflyers?

The S&P 500 Index (SPX) is up about 15% on the year, and a decent number of stocks have doubled in value. Investors are naturally drawn to these highflyers. I was curious to see if these stocks tend to continue their amazing climb or if they tend to give back some of their gains during the rest of the year. My analysis below will hopefully help us determine whether to invest in stocks that have had a meteoric rise earlier in the year.

Stocks that Doubled vs. the Others

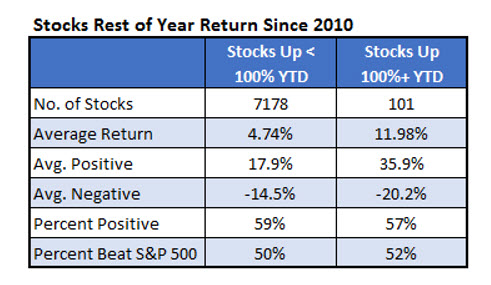

For this study, I went back to 2010 and found individual stock returns around this time of year (mid-August). The stocks had to have at least 10 analyst ranks at the time to be considered. I separated the stocks by those that were up 100% or more year-to-date and those that were not. The table below summarizes their rest of year returns.

Based on this analysis, there is good reason to focus on these high-flying stocks. The 101 stocks that doubled in value on the year gained an average of about 12% for the rest of the year, compared to 4.74% for other stocks. Whether or not a stock was up 100% on the year did not affect its chances of being positive or beating the S&P 500 for the rest of the year. The reason for the outperformance is that even though these stocks were up significantly at this point in the year, they still had a lot of upside to go. The stocks that were up 100% on the year and were positive for the rest of the year averaged a gain of about 36%. Other stocks that were up averaged a gain of about 18%.

Breaking Down 100% Winners

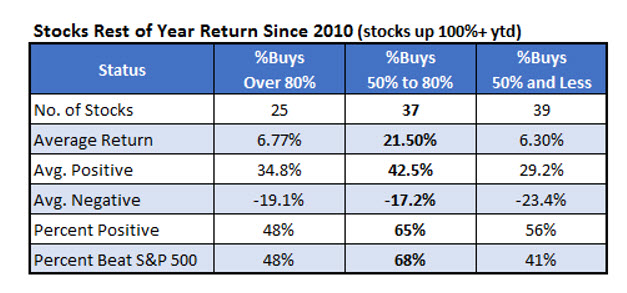

I took the 101 stocks that had doubled on the year historically at this point and broke them down by how much love they were getting from analysts. For this, I used our buy/sell/hold data we get from Zacks Research. As a contrarian, I was expecting the least loved stocks to perform best during the rest of year, but that wasn’t the case. The stocks that did the best by far were those that analysts were moderately bullish on. That is, stocks where the percentage of buy recommendations were over 50% and not more than 80%. Those stocks averaged an impressive 20% return for the rest of the year with 68% of them beating the S&P 500. Those are impressive figures. Stocks that were overwhelmingly loved or hated performed adequately for the rest of the year.

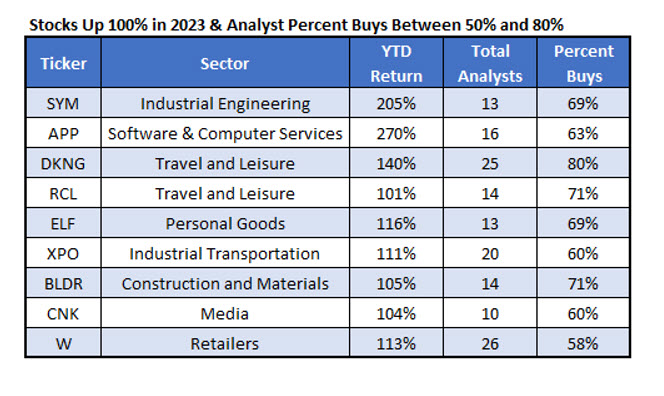

Naturally, I was curious to see if there were any stocks that currently met these criteria. Here are the nine stocks that have doubled in value on the year and have at least 10 analysts with buy ratings, with between 50% and 80% of analysts having a buy rating. Since 2010, stocks that met these criteria have outperformed the market significantly in the remaining months of the year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.