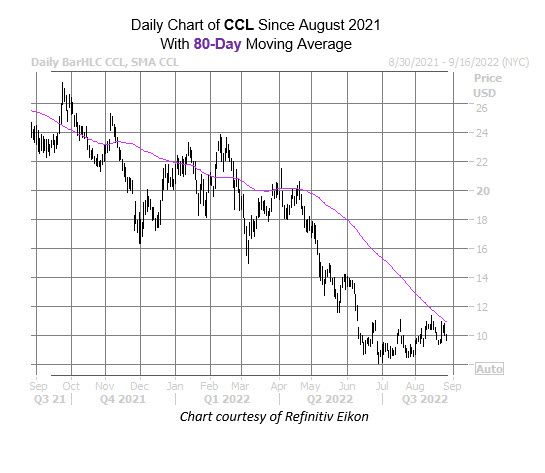

The stock just ran into a historically bearish trendline on the chart

The shares of Carnival Corp (NYSE:CCL) are flat this afternoon, last seen trading at $9.98. The stock has been chopping around below the $11 level for several months now, with a more than 50% year-to-date deficit under it’s belt. And now, there’s evidence suggesting CCL could chop even lower heading into September, if history is any indicator.

This is because Carnival stock just came within one standard deviation of its 80-day moving average after a lengthy period below the trendline. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, there have been five similar instances in the past three years. One month after 80% of these occurrences, CCL was lower, averaging an 11.6% drop during this time period. A similar move from its current perch would put the equity at $8.82 — dangerously close to its June 30, two-year low of $8.10.

Analysts have been hesitant on CCL, but a further shift could create even more headwinds. Of the 14 in coverage, three still say “strong buy.” Plus, the 12-month consensus price target of $13.92 is a 39.5% premium to current levels.

An unwinding of optimism among options traders could add additional pressure as well. The equity sports a 10-day call/put volume ratio of 4.19 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 93rd percentile of its annual range. In other words, options traders are picking up calls at a much quicker-than-usual clip.

Image and article originally from www.schaeffersresearch.com. Read the original article here.