The security received a downgrade to “underperform” at Wolfe Research

Streaming name Roku Inc (NASDAQ:ROKU) is drawing mixed analyst attention today. Wolfe Research downgraded the security to “underperform” from “peer perform,” noting net subscriber additions and average revenue per user “face mounting challenges.” On the other hand, Raymond James initiated ROKU coverage with a “market perform” rating, adding the company is well-positioned as the leading TV operating system in North America and could grow internationally.

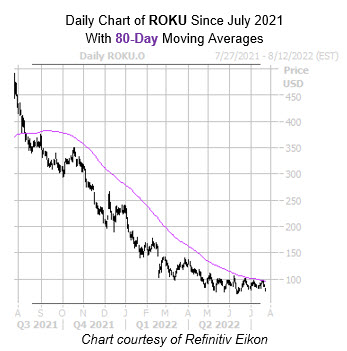

Last seen down 9.3% to trade at $78.64, Roku stock earlier breached a floor at the $80 level, which had been in place since mid-June. Overhead pressure at the descending 80-day moving average has been pressuring the stock for almost an entire year, and over the last nine months ROKU has shed 75.7%.

Short-term options traders have been overwhelmingly pessimistic towards Roku stock. This is per its Schaeffer’s put/call open interest ratio (SOIR) of 1.21, which stands higher than all readings from the last year. In other words, these traders have rarely been more put-biased.

Image and article originally from www.schaeffersresearch.com. Read the original article here.