Telsey Advisory Group hiked the security’s price target to $315 from $285

Home furnishing concern RH (NYSE:RH) is attracting bullish analyst attention ahead of its fiscal third-quarter earnings report, which is due out after the close tomorrow, Sept. 8. The security received a price-target hike from Telsey Advisory Group to $315 from $285 earlier, with the firm noting it expects to see attention drift towards RH’s demand trends, as well as potential improvement from its last update, when it trimmed its 2022 revenue outlook. At last check, RH is up 4.4% at $254.43.

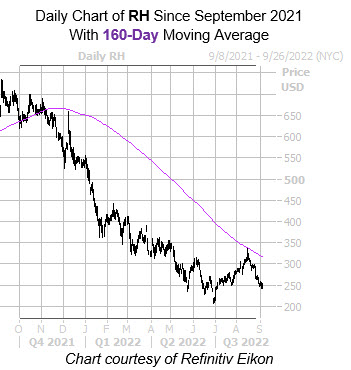

The equity has been testing a familiar floor at the $240 region lately, after its August rally lost steam just shy of the $340 mark. The 160-day moving average has been pressuring the shares lower since November, contributing to RH stock’s hefty 61.9% year-over-year deficit.

The security has an impressive record of post-earnings moves, however. Shares have finished six of eight next-day sessions higher, including a 20.1% rise in September 2020. RH averaged a move of 9.4% in the past two years, regardless of direction, but this time around the options pits pricing in a much bigger swing of 13.6%.

While the majority of analysts is already bullish, there is still room for upgrades. Of the 16 firms in coverage, six still call RH a “hold.” And though short interest is down 5.5% in the last two reporting periods, the 2.23 million shares sold short make up 10.4% of the equity’s available float. A further unwinding of these bearish bets could generate even more tailwinds for the stock.

A sentiment shift in the options pits would bode well for RH, too. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity’s 10-day put/call volume ratio of 1.47 ranks in the 96th percentile of its annual range. This means puts have been much more popular of late.

Image and article originally from www.schaeffersresearch.com. Read the original article here.