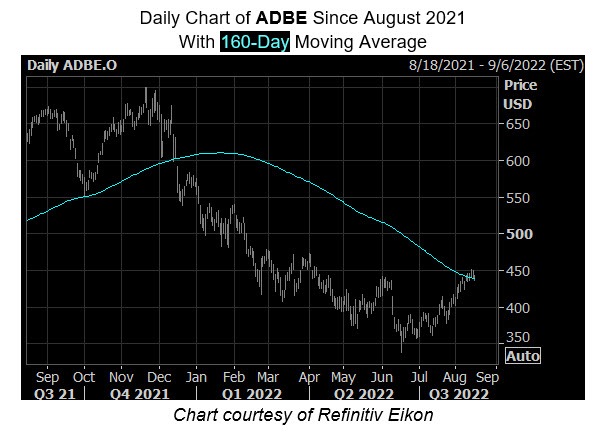

Adobe stock has cleared several key trendlines

When we last checked in with Adobe Inc. (NASDAQ:ADBE) earlier this summer, the software stock was gearing up for its second-quarter earnings report. Now, roughly two months later, ADBE is in focus once more.

Adobe stock is up 20% this quarter alone, toppling all sorts of descending short-term trendlines that had served as resistance. And despite a 30% year-over-year deficit, 19 of 22 brokerages rate ADBE a “buy” or better, with zero “sells” on the books.

ADBE continues to maintain a rich valuation at a forward price-earnings ratio of 28.17 and a price-sales ratio of 12.73. Nonetheless, Adobe stock provides a solid set of fundamentals for long-term investors; company holds a manageable balance sheet with $5.3 billion in cash and $4.66 billion in total debt.

ADBE offers an attractive growth rate, having increased its annual revenues and net income 84.9% and 88.7%, respectively, since fiscal 2018. Adobe is also expected to report 11.9% revenue growth and 8.3% earnings growth for fiscal 2022. Furthermore, the computer software company is estimated to see a 13.9% increase in revenues and a 17.3% increase in earnings in fiscal 2023, making Adobe stock a viable option for growth investors.

Options are certainly an intriguing route, per the security’s Schaeffer’s Volatility Scorecard (SVS) at a 96 out of 100, meaning Adobe stock has exceeded option traders’ volatility expectations in the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.