Dzmitry Dzemidovich

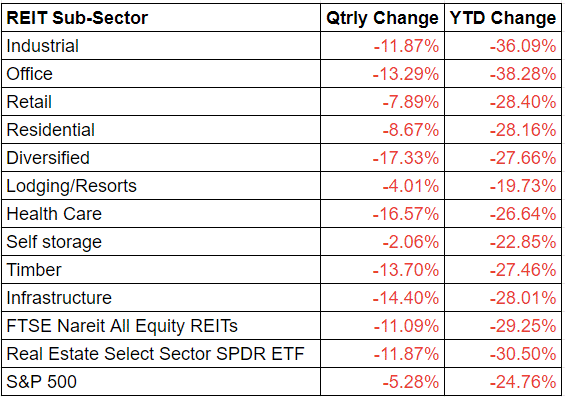

The real estate continued to bleed in Q3 with FTSE Nareit All Equity REITs index falling 11.1%, Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) fell 11.87%, while the broader index S&P 500 (NYSEARCA:SPY) fell just 5.28%.

All real estate sub-sectors declined. Self-storage and Lodging resorts were the relative outperformers, while diversified was the noticeable laggard.

YTD, FTSE Nareit All Equity REITs index fell 29.25%, Real Estate Select Sector SPDR ETF (XLRE) fell 30.5%, while the broader index S&P 500 (SPY) fell 24.76%. Industrial was the major dragger, while Self-storage and Lodging resorts were the relative outperformers.

Real estate has been under pressure in the quarter as the Fed raised interest rate by 150 bps across two meetings to the 3%-3.25% range. Fed’s aggressive fight against inflation is expected to push interest rates to 4.4% by December, putting a damper on the real estate market.

Here is a look at the performance of the subsectors.

REITs are down heavily in the recent past. They have dropped mainly due to rising interest rates, and the Federal Reserve has made it clear that they expect to hike rates again in the near term, according to Seeking Alpha Author Jussi Askola.

It may seem as if REITs are likely to drop a lot more in the near term. However, the share prices can recover just as fast as they dropped, and the shift in market direction is always unexpected, Askola noted.

Many investors are expecting that high inflation and interest rates will suppress the red-hot real estate market, and as a result, they are quick to assume a 2008-style-kind-of-crash for REITs, Author Riyado Sofian said, adding that his opinion differs.

REITs have historically outperformed the markets during times of high inflation. This is because REITs have high operating margins of around 60%. Furthermore, higher rents can be an inflation buffer, according to Sofian.

Also, REITs’ balance sheets are the strongest they’ve ever been, the analyst noted.

Equity REITs have outperformed broad equities year-to-date, Author Global X ETFs said.

We are positive on the outlook for REITs given their now attractive yields and yield pick-up relative to traditional fixed income and equity, according to the author.

Here are some ETFs to keep a watch on: Vanguard Real Estate ETF (NYSEARCA:VNQ), Real Estate Select Sector SPDR ETF (XLRE), Vanguard Global ex-U.S. Real Estate ETF (NASDAQ:VNQI), iShares Mortgage Real Estate Capped ETF (BATS:REM), iShares Residential Real Estate Capped ETF (NYSEARCA:REZ), iShares U.S. Real Estate ETF (IYR), Pacer Funds Trust – Pacer Benchmark Industrial Real Estate SCTR ETF (INDS), ETF Series Solutions – NETLease Corporate Real Estate ETF (NETL), SPDR Homebuilders ETF (XHB), IndexIQ ETF Trust – IQ U.S. Real Estate Small Cap ETF (ROOF) and ETF Series Solutions – Hoya Capital Housing ETF (HOMZ).

Image and article originally from seekingalpha.com. Read the original article here.