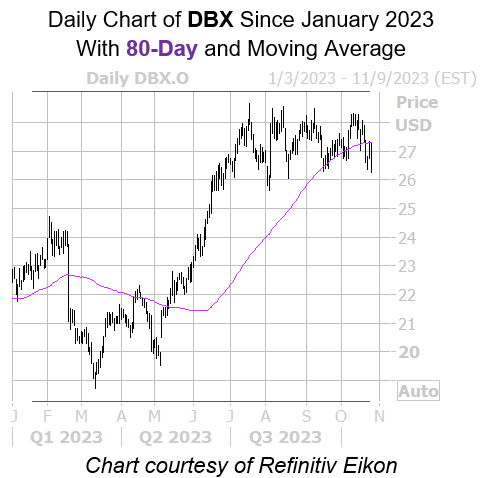

The security pulled back to the 80-day moving average

Dropbox Inc (NASDAQ:DBX) is down 3.7% at $26.30 at last check, as the tech sector struggles on the heels of Alphabet’s (GOOGL) cloud revenue miss. The security is still up 17.8% so far this year, though the $129 region rejected several advances so far this year. The equity could soon attempt to conquer that level again, though, as it’s pulled back to a historically bullish trendline.

Per data from Schaeffer’s Senior Quantitative Analyst Rocky White, Dropbox stock is within one standard deviation of its 80-day moving average. The equity saw at least five similar signals over the last three years, defined for this study as having traded north of the moving average 80% of the time in the past two months, and in eight of the last 10 trading days. DBX finished higher one month later in 80% of those instances, with an average 5.2% gain.

An unwinding of short interest could provide tailwinds as well. The 21.49 million shares sold short account for 8.4% of the stock’s available float, or nearly eight days’ worth of pent-up buying power.

Image and article originally from www.schaeffersresearch.com. Read the original article here.