Cybersecurity stocks will become more critical to everyday life

Subscribers to Chart of the Week received this commentary on Sunday, December 24.

Taylor Swift may have won Time Person of the Year, but in the investing world, artificial intelligence (AI) was the buzzword of 2023. Per FactSet, 152 of the S&P 500 Index (SPX) companies cited AI during their earnings call in the third quarter. The number was 180 for the second quarter, both figures at 10-year highs. Or you can take our word for it; we wrote about artificial intelligence 113 times from 2015-2022, and it was covered 137 times in 2023 alone. It’s yet another example of how the Magnificent 7 – all purveyors of AI in some capacity – have on the broad market.

But beyond the advances made by the Magnificent 7, most of the AI buzz in 2023 was speculative, in the same way cryptocurrencies, cannabis, and sports betting dominated headlines in recent years when they reached mainstream consciousness. Investors are always looking to get in on the Next Big Thing at the ground floor because that’s where the value is. With that in mind, here are some potential trends and storylines to monitor going into 2024.

Quantum Computing

File quantum computing under, ‘Definitely maybe,’ because the technology feels like it has been on the cusp of a breakthrough for the last 10 years. But this year — we swear! — it could become more of a household name. A few weeks ago, International Business Machines (IBM) unveiled Quantum System Two., a new architecture for scaling our quantum computers into the future. System Two uses three “Heron” cryogenically cooled chips that could produce quantum machines by 2033. That may seem far off, but this is just one company; Microsoft, Alphabet, and even Baidu are in the race to develop quantum technology.

Per a 60 Minutes segment, “these machines allow problems in physics, chemistry, engineering and medicine to be solved in minutes that would take today’s supercomputers millions of years to complete – if at all.” If there’s enough legitimate speculative buzz, then IBM, the Magnificent 7, and more specialized names like IONQ (IONQ) could all stand to benefit from positive developments. The jury’s out if this is all fairy dust, but a few dart throws with options mean you can dip your toe in without pushing all of your chips into the quantum success.

Second-Derivative AI

Second-derivative, to borrow from Morningstar, refers to “companies or sectors that can improve margins by using AI capabilities in their products, offer much better valuations with earnings upside.” All of that AI speculation of 2023 will progress to real-life applications in 2024: Goldman Sachs called it in a recent research piece, “the year of deployment.” Beyond the obvious semiconductor and tech-adjacent benefits, a sharpened-up generative AI could help improve the efficiency of any sector, whether it be health, retail, or industrial. Be on the lookout for companies that adopt AI and their subsequent earnings reports, making a short-term play on a post-earnings bull gap could be a quick way to make big returns.

CRISPR

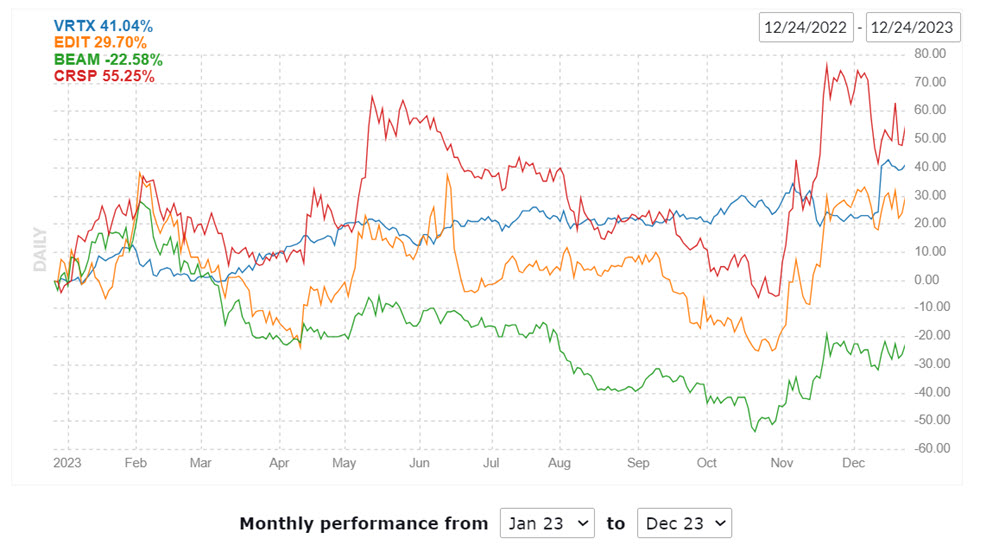

On Dec. 8, the Food and Drug Administration (FDA) approved CRISPR Therapeutics’ (CRSP) gene-editing therapy, Casgevy, for sickle cell disease. It’s the first approval of its kind for a therapy utilizing the CRISPR/Cas9 gene-editing technology. CRSP hasn’t traded well on the news, down nearly 10% in December alone. Gene-editing peer, meanwhile, Vertex Pharmaceuticals (VRTX) entered into a licensing agreement with Editas Medicine (EDIT). Both VRTX and EDIT are up 16% and 38% in the quarter, respectively. Another sector peer, Beam Therapeutics (BEAM) is 22% higher this quarter. While that may seem like the CRSPR progress has already been priced in, BEAM, CRSP, and EDIT all have more than 15% of their total available float sold short. If the CRSPR applications make progress in 2024, shorts will be caught off guard and a covering rally could ensue.

Cybersecurity

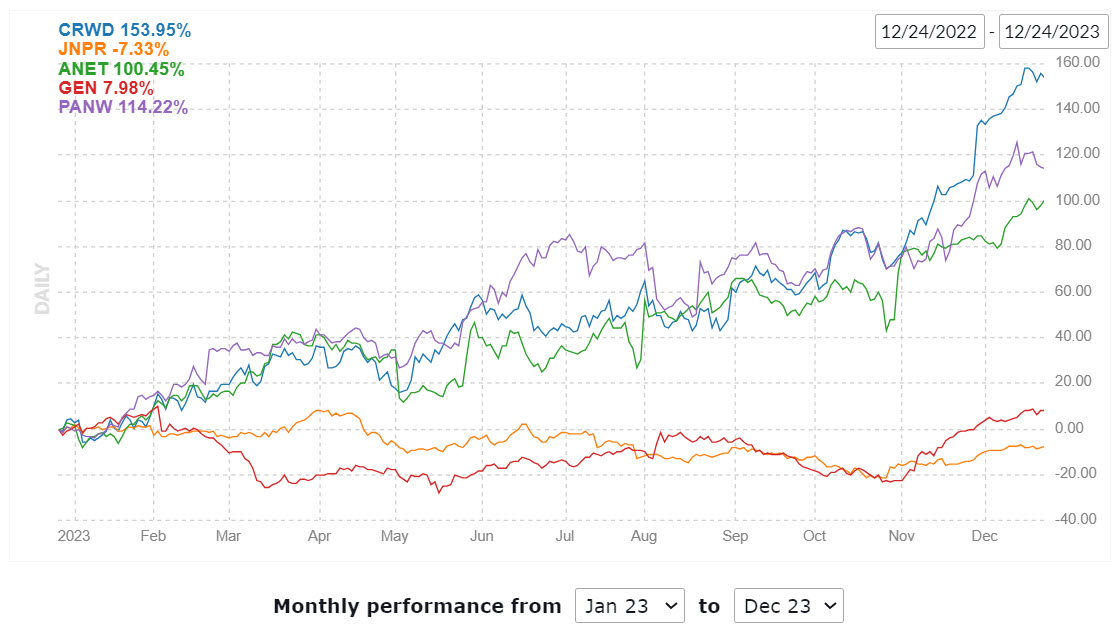

As cloud software becomes vertically integrated, and generative AI hits mainstream consciousness – no pun intended — cybersecurity stocks will become more critical to everyday life. CrowdStrike (CRWD) and Gen Digital (GEN) are major players to watch, as well as Arista Networks (ANET), Palo Alto Networks (PANW), and Juniper Networks (JNPR). CRWD is up 142% in 2023 while ANET and PANW are up over 100% year-to-date. But GEN is only up 7% year-to-date, while JNPR is down 7%.

From everyone here at Schaeffer’s, we want to wish you a happy and healthy holiday season, and a sincere thank you for following this space week in and week out. The holidays are a time for family and winding down. But in that quiet space between Christmas and New Years, there’s an opportunity for shrewd investors to take stock of what’s working, what’s not, and what to watch for in 2024. If you walk away from this article with at least one flickering idea in the back of your head for 2024, then we’ve done our Christmas Eve duty.

Image and article originally from www.schaeffersresearch.com. Read the original article here.