Pinduoduo stock is trading near a historically bullish trendline

China-based e-commerce platform Pinduoduo Inc (NASDAQ:PDD) is brushing off news that Google is suspending the Pinduoduo app due to security concerns. Despite this, the shares were last seen 1% higher to trade at $79.72. Even better, the equity’s recent dip has put it near a historically bullish trendline.

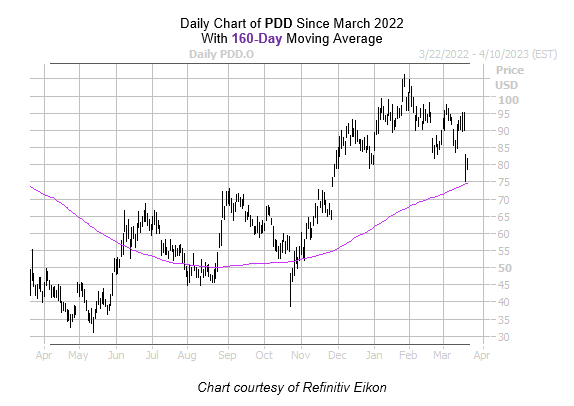

According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, PDD is within one standard deviation of its 160-day moving average. Per White’s data, Pinduoduo stock was positive one month later all three times this signal popped up over the last three years, and averaged a 13.1% gain. From its current perch, a similar move would put the stock just over $90.

On the charts, the shares yesterday shed nearly 14.2%, resulting in a bear gap that pushed them to their first close below the $80 level since November. Despite a fractional year-to-date deficit, PDD is up almost 100% in the last 12 months.

An unwinding of options traders pessimism could create additional tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Pinduoduo stock’s 10-day put/call volume ratio of 1.01 ranks higher than 86% of readings from the past year. What’s more, PDD’s Schaeffer’s put/call open interest ratio (SOIR) of 1.41 stands in the highest percentile of its annual readings.

The stock’s Schaeffer’s Volatility Index (SVI) of 54% stands in the low 9th percentile of the past 12 months. This means that options traders are pricing in low volatility expectations at the moment — a good thing for premium buyers.

Image and article originally from www.schaeffersresearch.com. Read the original article here.